Non-fungible tokens (NFT) have been a topic in the Japanese crypto industry since early 2018. With the NFT craze in 2021, they have become increasingly popular and seen more mainstream adoption. It does, therefore, not come as a surprise that the Japan Cryptocurrency Business Association (JCBA) and Blockchain Contents Association (BCA), as two of the leading industry associations in Japan, issued NFT guidelines more recently.

In this article, we are taking a closer look at the state of the Japanese NFT market and the legal and regulatory environment for NFTs while considering the JCBA and the BCA guidelines.

| JCBA NFT-guidelines (April 2021, written in Japanese) https://cryptocurrency-association.org/dl/nft_guideline202104.pdf BCA NFT-guidelines (2nd edition) (December 2020, written in Japanese) https://eb3d626b-4b51-42f2-b2d4-0f682cc5645e.filesusr.com/ugd/e9a87a_2028e5c7115d4fcd933e9f55e6262762.pdf |

| We have been advising leading blockchain gaming companies on NFTs and other NFT-related matters since early 2018. In case you are looking for more information on blockchain games and crypto art, you might find the following two articles interesting. Blockchain Games and the Japanese Law (November 2018, written in Japanese) https://innovationlaw.jp/blockchain-games-under-japanese-laws/ Buyer Beware – Digital Art and Non-Fungible Tokens (NFT) https://innovationlaw.jp/en/buyer-beware-digital-art-and-non-fungible-tokens-nft/ |

Traditionally, items purchased in a game could only be used within the game and not be transferred to other players. This has changed with blockchain games, where game items are represented by NFTs. By allowing players to control the NFTs, they become able to buy, sell, exchange, and lend items represented by NFTs to other players – even outside of the game. According to the JCBA, the use of NFTs further ensures that the game assets do not disappear after the termination of the game. What is most likely meant is that the NFT does not cease to exist. Yet, it may lose its value as the represented asset might not be used anymore due to the termination of the game.

Popular blockchain games on the Japanese market include My Crypto Heroes, Crypto Spells, and Contract Servant.

| Traditional online games | Blockchain games |

|

|

Source: JCBA Guideline, page 4.

(1) My Crypto Heroes

My Crypto Heroes by double jump.tokyo was released in November 2018. The game is an RPG in which players can gather, build their character, and win items by completing challenges and fighting enemies. Both heroes and items are represented by NFTs and can be freely transferred peer-to-peer or traded on NFT markets.

My Crypto Heroes fast became the world’s number one blockchain game and still has the highest number of (active) users and transactions.

(2) Crypto Spells

Crypto Spells by Crypto Games is a card game in which players use cards represented by NFTs to fight with the computer and other players. There are several ways to acquire new cards, including battles and trading/exchanging them with other players within and outside the game.

(3) Contract Servant

Contract Servant by Axel Mark is a card game in which players have a deck of eight cards (servants). There are two types of servants – common servants and token servants, where the token servant is issued as an NFT. The tokens can then be traded among players through a market function. Players are further able to earn rewards from league battles each week.

(4) Other Notable Games

Other notable blockchain games in Japan are Crypton, Crypton Racing, and Brave Frontier Heroes. Further, double jump.toyko launched MCH+, a blockchain game development program that is based on the knowledge gained from My Crypto Heroes.

In February 2021, Christies sold a Beeple artwork for JPY 7.5 billion. The artwork itself is stored on the InterPlanetary File System (IPFS) and represented by an NFT on the Ethereum blockchain. In Japan, a number of crypto art related services have been launched more recently. The major platforms are nanakusa, NFT Studio, and Token Link.

(1) nanakusa

In March 2021, Smart App released nanakusa – a marketplace for crypto art. nanakusa allows crypto artists to mint NFTs and sell crypto art via the platform. Purchasers of crypto art may further sell artworks – or more precisely, the NFT representing the artwork – via the trading platforms. From the information provided, it seems that royalties are paid to the crypto artists for all secondary sales.

(2) NFT Studio

In March 2021, CryptoGames released NFT studio. The platform allows artists to mint NFTs on Ethereum and Polygon for their crypto art. Similar to nanakusa, NFT studio includes features that allow artists to participate in the price for secondary sales.

(3) TOKEN LINK

In January 2021, Platinum Egg released Token Link, an NFT market for game items. Only a few months later, in April, Platinum Egg implemented an auction mechanism for crypto art.

(1) Coincheck NFT Market

In March 2021, Coincheck, the operator of one of the largest crypto exchanges in Japan, launched an NFT market. Currently, the only NFTs listed on the market are from Crypto Spells and The Sandbox. More NFTs will be listed in the future. The company has 2 million active users and hundreds of billions of yen in crypto assets under custody. As such, Coincheck will be an important partner for content providers and a gateway to the Japanese market for foreign projects.

When applying for listing, from our experience, projects must provide Coincheck with information about the blockchain used, the primary sale, IP content, and, where applicable, transaction volumes on other markets. As Coincheck is a member of the JCBA and a head of the NFT committee of the JCBA, it is also valuable to check JCBA guidelines in more detail.

(2) Participation by Major Companies

While Coincheck’s NFT market is the first of its kind in Japan, other major companies, including Mercari[1], LINE[2] and GMO Internet group[3] have announced that they are considering launching their NFT market. The entry of other major players is a clear sign that NFTs are gaining increasing mainstream traction on the Japanese market.

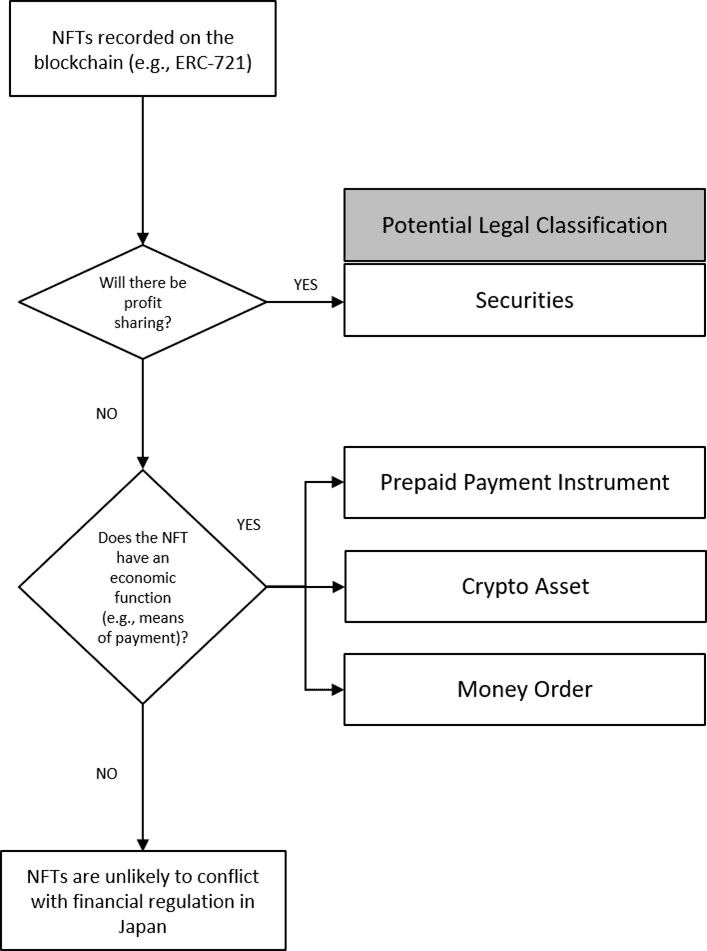

Currently, there are no laws and regulations that specifically deal with NFTs. Depending on their design, NFTs may, however, fall under the definition of crypto assets, prepaid payment instruments, or money orders under the Payment Services Act (PSA) or the Banking Act or constitute securities within the meaning of the Financial Instruments and Exchange Act (FIEA). Whether this is the case must be analyzed on a case-by-case basis. The guidelines prepared by the JCBA and the BCA aim to provide some more clarity in this regard.

(1) JCBA guidelines

The JCBA is one of the leading industry associations in Japan. Its members range from crypto-asset exchanges to other crypto asset service providers. The NFT committee of the JCBA issued NFT guidelines on April 26, 2021. The guidelines are meant to provide local and foreign NFT issuers with more clarity when applying for a listing on a Japanese NFT market.

| Matters covered by the JCBA guidelines |

| (1) Use cases of NFTs (2) Flowchart for determining whether NFTS fall under existing laws and regulations (3) Profit-sharing arrangements (4) Settlement (5) Gambling (6) Premiums and Representations Act (7) Anonymity and privacy (8) Security (9) User protection (10) Handling of new NFTs (type of NFT that requires careful handling) |

The following chart provides a good overview of the key considerations when determining the legal and regulatory environment for NFTs.

In the case of blockchain games, it is also necessary to consider gambling laws. According to Japanese criminal law, gambling is a criminal offense. It is defined as a game of chance where players can win monetary prizes, except for small gifts. While the definition is rather blurry, NFT issuers implementing mechanics similar to gatcha should consider gambling regulations carefully.

Blockchain games that include incentives for users, such as the free issuance of NFTs, must further comply with the Premiums and Representations Act. The Premiums and Representations Act regulates the free provision of goods and services by a business which aims to induce potential customers to buy the business’s products or services.

The Premiums and Representations Act stipulates limits for lotteries, competitions, etc. While the total amount differs, the following limits must generally be considered for lotteries and other competitions.

| Description | Examples | The maximum amount of premiums | |

| Premiums (general) | Premiums that are offered to anyone visiting a shop or anyone purchasing goods or services. | Gifts to all purchasers, gifts to all visitors, etc. | (1) If the transaction price is less than JPY 1,000, the premium must not exceed JPY 200. (2) If the transaction price is JPY 1,000 or more, the premium must not exceed 2/10 of the total transaction price. |

| Premiums and prices (game of luck and game of skill) | Premiums that are given to users as prices in a game of chance or skill. | Lotteries at the store. Quiz games and other games |

(1) If the transaction value is less than JPY 5,000, the maximum amount of the prize must not exceed 20x the transaction value. (2) If the transaction value is JPY 5,000 or more, the maximum amount of the prize must not exceed JPY 100,000. ※Both are capped at 2% of the total transaction value. |

Source: Prepared by our office based on the Consumer Affairs Agency website, etc.

The JCBA guidelines further provide that NFT issuers should implement measures that prevent users from using NFTs for money laundering and terrorist financing; consider security risks for storing NFTs and implement measures to deal with thefts or losses; properly explain to users that there is the risk that the NFT might become worthless if the service is terminated; and consider that NFTs are highly likely to be used for criminal purposes, including money laundering.

(2) BCA guidelines

The BCA was established by SNS and gaming companies and is involved in a number of initiatives aiming at the protection of minors and the elderly when using blockchain applications. On March 24, 2020, the BCA published the BCA guidelines on blockchain content (incl. NFTs) to protect consumers and promote self-regulation. A revised version of the paper was published on December 25, 2020.

| Matters covered by the BCA guidelines |

| (1) Gambling (2) Premiums and Representations Act (3) PSA (4) FIEA (5) Prevention of scams and other fraudulent practices |

The interpretation of the laws and regulations, including the PSA, FIEA, Gambling Laws, and Premiums and Representations Act, is largely in line with the interpretation by the JCBA.

With respect to gambling, the BCA guidelines hold that blockchain games should avoid or at least carefully consider implementing any of the following mechanics: (i) in-game gachas (vending machine type mechanics) that issue NFTs or other in-game items; (ii) collection of fees to participate in rewards.; (iii) randomized creation and burning of NFTs and other in-game items with monetary value; and (iv) collection of fees to participate in competitions where the collected fees are distributed to the participants depending on their ranking.

The BCA guidelines further include self-regulation for member companies that include (i) the prohibition of loss compensation, (ii) the prohibition of insider trading, (iii) the monitoring and prevention of market manipulation, and (iv) the obligation to disclose material information to all users.

In addition, the guidelines hold that the issuance of NFTs may involve scams and other fraudulent practices, such as the termination of services shortly after selling the NFTs. To prevent fraudulent practices, member organizations are advised to (i) provide all material information to their users, (ii) secure the necessary funds and resources to ensure that the content shown to the users is actually delivered, and (iii) conduct test sales of NFTs and extensive beta-testing to enable users to understand the content of the services and NFTs prior to the actual launch.

Given the fact that NFTs are a relatively new phenomenon that is still evolving, many issues are yet solved. The following explanations are meant to provide some guidance for matters not included in the BCA and JCBA guidelines but relevant for the industry.

(1) NFTs and External Services

In most cases, the data represented by NFTs is stored off-chain. This raises the question of how consumers can be protected from later changes to the service and what companies can do to avoid claims for damages. In the case of blockchain games, NFTs typically represent assets that are stored on the servers of the blockchain game company. If the company now decides to change its terms of use or to terminate its services, this may ultimately render the NFT worthless and, in some cases, non-functional. To ensure that the game company does not face any claims for damage, this scenario must sufficiently be covered in terms of use. The same applies to crypto art, where the artworks are stored on the servers of a marketplace. If the data is stored and subsequently deleted on the InterPlanetary File System (IPFS), the situation is much more unclear and requires further consideration.

(2) NFTs and IP

For NFTs that are used for crypto art or in blockchain games, it is necessary to consider the relationship between the content provider and the holder of the NFT carefully. Two aspects are of utmost importance. First, the rights that are represented by the NFT should be clearly stipulated in the sales documentation of the initial sale. This also includes the question of how the rights represented by the NFT are transferred. Second, the relationship between the off-chain data and the NFT, as well as the retention of the off-chain data, should be considered carefully to avoid potential actions for damages. In cases where the content provider participates in all further sales, this should be clearly indicated in the contract as well. In the future, it is possible to discuss what rights should be granted as best practices.

(3) Issues concerning the trading of NFTs

If not explicitly provided in the contract, it is unclear under Japanese laws whether the rights represented by an NFT – i.e., the economic substance – are transferred (i) if both parties agree to the transfer and the transfer is recorded on the blockchain or (i) by mere agreement. To increase legal certainty and to ensure that the data recorded on the blockchain accurately reflects reality, the terms of sale should clearly stipulate that transfers only become effective if it is recorded on the blockchain. While there is no legal precedent, we believe that this solution is most practical and reflects the parties’ intentions.

(4) Taxation of NFTs

The taxation of NFTs another issue to be considered. In February 2019, the Japan Cryptocurrency Tax Association (JCTA) found that the taxation of income from the sale of NFTs is “an issue that has not been clarified in tax law.” The document finds, however, that “NFTs have an independent value, and if income is generated from the sale or exchange of NFTs, it will generally be taxed as miscellaneous income.”

(5) Secondary distribution of NFTs and rewards for creators

For many projects, content creators are rewarded when a secondary sale takes place. Examples are the above-mentioned nanakusa and NFT Studio, who both pay royalties to the content creator for secondary sales. In other cases, the content creator might want to transfer all his IPs to achieve higher prices for the initial sale. It is likely that both models will exist side by side in the future, but best practices still have to evolve. Further discussions are necessary in that regard.

Disclaimer

The content of this article has not been confirmed by the relevant authorities or organizations mentioned in the article but merely reflects a reasonable interpretation of their statements. The interpretation of the laws and regulations reflects our current understanding and may therefore change in the future. This article does not recommend the use of or investment in NFTs. This article provides merely a summary for discussion purposes. If you need legal advice on a specific topic, please feel free to contact us.

EOD

[1] On April 2, 2021, Mercari announced that it established a new company to plan and develop blockchain-related services, including NFTs.

[2] LINE tweeted recently that it is building an NFT platform. The tweet states that it intends to build services that make it easy to mint, buy, sell, and exchange NFTs.

[3] GMO announced developing a marketplace that allows users to buy and sell NFTs representing digital art and music from famous artists.