Is the Android ‘Me’ the Same Person?- Future Legal Systems Contemplated at Osaka Kansai Expo 2025

Is the Android ‘Me’ the Same Person?- Future Legal Systems Contemplated at Osaka Kansai Expo 2025

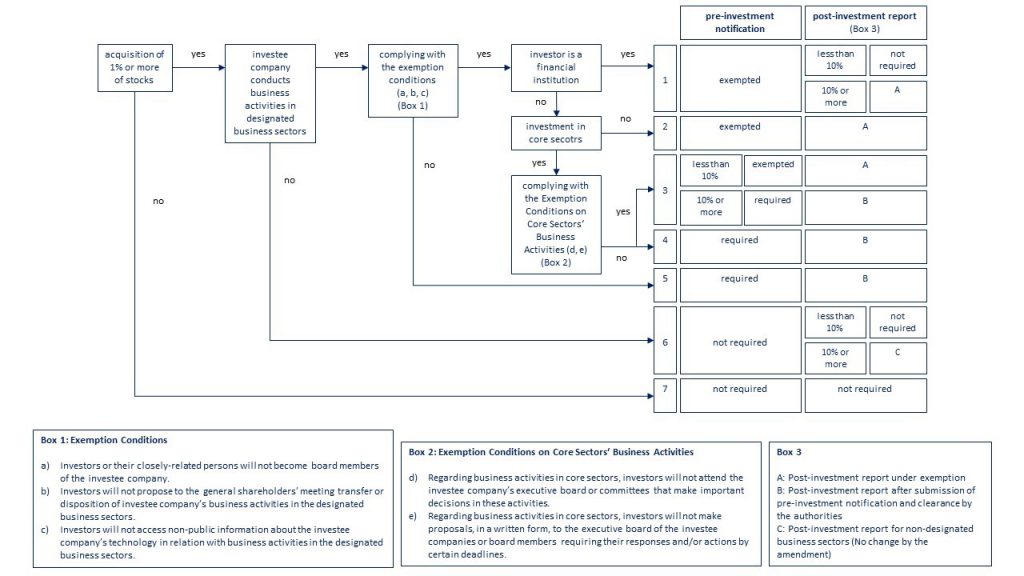

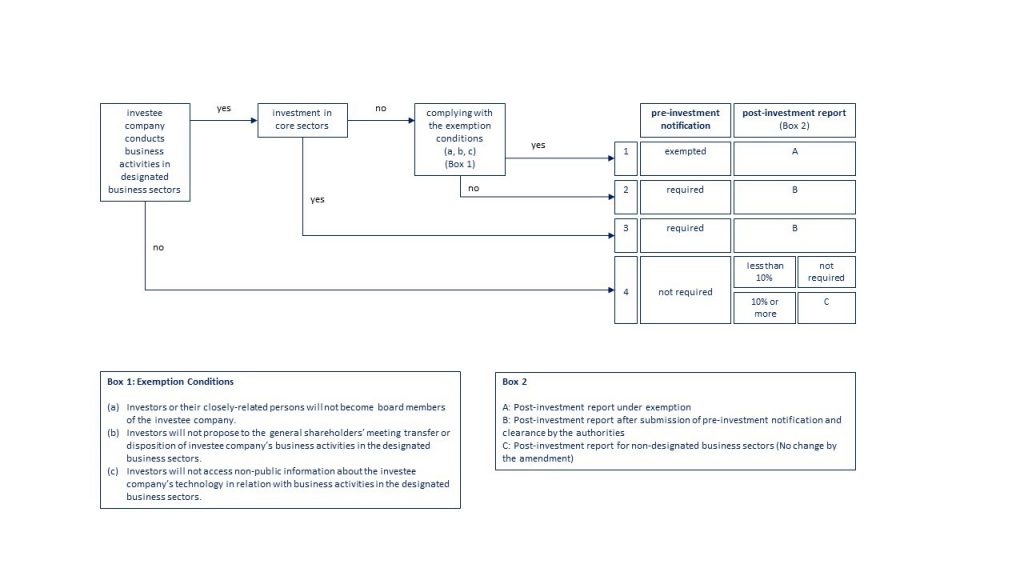

Earlier last year, the Japanese government started to tighten the rules on foreign direct investments (FDI) by adding, among others, certain sectors in the information and communication technology and software development to the list of restricted industries. Foreign investments in companies that operate in these sectors are generally subject to pre-transactional approval by the relevant authorities if they exceed certain thresholds. With the latest amendments, the legislator lowered the threshold for the acquisition of shares in listed companies from 10% to 1%. At the same time, exemptions were introduced allowing foreign investors under certain conditions to buy shares above these thresholds without obtaining prior approval.

The changes entered into force on May 8, 2020 and apply to all investments on or after June 7, 2020.

The Foreign Exchange and Foreign Trade Act (Act) aims “to enable the proper development for foreign transactions and the maintenance of peace and security in Japan”. To ensure that these goals are achieved, the Act limits among others foreign investments in sectors which are vital to national security (e.g. infrastructure, aviation, nuclear technology).

Only in 2019, the legislator added the ICT industry, etc. to the list of restricted sectors. The move reflected the increasing importance of those industries in a national security context and was largely in line with developments in other jurisdictions.

This time, the legislator extended the definition of foreign investors and lowered the threshold for investments in listed companies irrespective of their industry. At the same time, some exemptions to the pre-transactional approval requirement were introduced for certain types of investors.

The Act defines foreign investors as (i) individuals who are non-residents, (ii) entities established under foreign laws or having their principal office in a foreign state, (iii) Japanese entities which are directly/indirectly controlled by persons set forth in item (i) and (ii), and (iv) entities in which the majority of directors are persons set forth in item (i). A person is considered to control an entity within the meaning of item (iii) if it holds 50% or more of the voting rights in a company. Whether the voting rights are held directly or through other entities controlled by the respective person is irrelevant.

With the latest amendment (iv) partnership-type investment funds were added to the definition of foreign investors provided, however, 50% or more of the total capital of the fund was contributed by persons indicated under item (i) and (ii) above.

The term “inward direct investment or equivalent action” is defined broadly. It includes (i) the acquisition of shares (both on primary and secondary markets), (ii) consenting to certain substantial changes to a company’s scope of business after the acquisition of the shares, (iii) the establishment of a branch offices, (iv) the issuance of loans of at least JPY 100 million and a term of one or more years[1], and (v) the succession of business by means of business transfer, absorption type company split or merger.

The acquisition of shares in a listed company is only considered a direct investment under the Act if the investor holds at least 1% of the outstanding shares or voting rights following the transaction. Whether the investor holds the shares or voting rights directly or through closely related persons is irrelevant. The definition of closely related persons is rather complex. At its core, it includes affiliates and business partners of a foreign investor where the investor is a company, and relatives of the investor if the investor is a natural person.

Out of the 1465 sectors under the Japan Standard Industrial Classification 155 sectors – including pharmaceuticals and medical devices for the containment of infectious diseases such as COVID-19 as per recent amendment – are designated business sectors under the regulations. As discussed in more detail in section 5 below, foreign direct investments into designated business sectors may trigger pre-transactional approval requirements.

The regulations further distinguish between core-designated sectors and non-core sectors. While some industries belong exclusively to core or non-core designated sectors, others may be covered by both.

Listed Companies: The Ministry of Finance (MoF) published an exhaustive list indicating for all listed companies in Japan, whether their activities fall within non-designated sectors, designated sectors other than core sectors, or core sectors. The full list can be found on the website of the MoF.

Unlisted Companies: For unlisted and private companies, it is necessary to assess in each case whether the relevant business falls within the designated sectors – and if so under the non-core or core sector – as different notification requirements apply for exempted investors. The full list of designated sectors can be found on the website of the MoF as well (only Japanese).[2]

Foreign investments in companies operating in designated sectors are generally subject to pre-transactional approval by the relevant authorities via the Bank of Japan (BoJ). For listed companies, the approval requirement is triggered when an investor holds 1% of the outstanding shares or voting rights subsequent to the investment either on his own or together with closely related persons.

For unlisted companies there are no thresholds. Investments in companies operating in the designated sectors are therefore subject to BoJ approval irrespective of the amount invested and the shares or voting rights held following to the investment.

| threshold | |

| listed companies | 1% |

| non-listed companies | n/a |

Investors who fail to obtain pre-transactional approval by the BoJ may be ordered to dispose of all acquired shares.

The new regulations provide for exemptions from the pre-transactional approval requirement for certain types of investors but only if these investors meet additional criteria.

The blanket exemption is available to foreign financial institutions which are subject to Japanese regulations or equivalent foreign regulations. The definition includes, banks, securities firms, insurance companies, asset management companies, trust companies, registered investment companies, as well as high-frequency traders[3].

In order to qualify for the blanket exemption these entities or closely related persons must

| (a) | not become board members of the investee company |

| (b) | not propose at a general shareholders’ meeting the transfer or disposition of the investee company’s business in the designated sector(s) |

| (c) | not gain access to non-public information about the investee company’s technology concerning the designated sectors. |

Financial institutions complying with these requirements do not have to obtain pre-transactional approval via the BoJ. This applies irrespective of whether the investee company operates in core or non-core designated sectors and irrespective of the number of shares or voting rights held following the investment.

If an exempted investor holds 10% or more of the shares or voting rights following the investment, it must however file a post-investment report with the BoJ.

Exemptions from the pre-transactional approval also apply to general investors (including sovereign wealth funds and public pension funds accredited by authorities). In contrast to the blanket exemption, it is necessary to distinguish between investments in companies operating in designated core sectors and companies operating in non-core sectors.

Non-core sectors: Investments in non-core sectors are exempted if the investor meets all the requirements under item (a) to (c) in section 6.1 above. It is however necessary to file a post-investment report, if the investor holds 1% of the shares or voting rights following the investment.

Core sectors: Investments in core sectors may only be exempted if the investor does not hold 10% or more of the shares or voting rights subsequent to the investment. In order to qualify for the exemption an investor must comply with the requirements under item (a) to (c) in section 6.1 above and must

| (d) | not attend the investee company’s executive board or committees that make important decisions on activities in the core sector |

| (e) | not make any proposals in writing to the executive board or board members requiring their responses and/or actions by certain deadlines. |

A post-investment report must also be filed in these cases provided the investor holds 1% or more of the shares[4] or voting rights following the investment.

Please note that a foreign investor is not required to obtain a pre-transactional approval if a company has only indicated restricted activities in its corporate documents (e.g. articles of incorporation, corporate registry) but has not operated in these sectors within 6 months prior to the investment. Even in this case, the foreign investor must however submit a post-investment report if he holds 10% or more of the voting rights of the investee company.

Investments that require pre-transactional approval must be notified to the BoJ before the investment is made. The notification must specify the purpose of the investment, the amount, the time and other information as specified by Cabinet Order. Once the notification is submitted, there is a 30-day waiting period during which the investment must not be executed. In practice the waiting period is generally shortened to 2 weeks. Under certain circumstances, the waiting period may, however, also be extended to a maximum of five months. To avoid unnecessary delays, foreign investors should engage in informal discussions with the relevant authorities prior to filing the notification.

Post-investment reports mainly serve statistical purposes and must be filed within 45 days after the respective investment is made.

Whether the latest amendments negatively affect the readiness of foreign investors to invest in Japanese companies remains to be seen. Given the newly implemented exemptions under the Act, it should however not hamper foreign investment unreasonably.

In any case, investors are well advised to check early whether their investments require pre-transaction approval by the BoJ and if so whether they are exempted. For listed companies this can be checked easily. For unlisted companies, it is necessary to assess in more detail whether the company falls under the designated sectors.

Please feel free to contact us if you have any questions in that regard and should you need our assistance.

[1] Loans issued by banks and other financial institutions in the course of trade are explicitly excluded from the definition.

[2] To see all items please visit https://www.mof.go.jp/international_policy/gaitame_kawase/fdi/publicnotice1-1.pdf, https://www.mof.go.jp/international_policy/gaitame_kawase/fdi/publicnotice1-2.pdf,https://www.mof.go.jp/

international_policy/gaitame_kawase/fdi/publicnotice1-3.pdf, https://www.mof.go.jp/international_policy/gaitame_

kawase/fdi/index.htm#joubun (accessed 20/07/2020).

[3] High-frequency traders are only eligible for the blanket exemption if they are registered with the Financial Services Agency.

[4] Please note that the foreign investor will have to submit (i) a report after the investor holds 3% or more of the shares or voting rights following the investment and (ii) a report for each acquisition after the investor holds 10% or more of the shares or voting rights following the investment.

[5] MOF, Rules and Regulations of the Foreign Exchange and Foreign Trade Act, p. 16 retrieved from https://www.mof.go.jp/english/international_policy/fdi/kanrenshiryou01_20200424.pdf (accessed 20/07/2020).

[6] Ibid, p. 17.

Is the Android ‘Me’ the Same Person?- Future Legal Systems Contemplated at Osaka Kansai Expo 2025

Is the Android ‘Me’ the Same Person?- Future Legal Systems Contemplated at Osaka Kansai Expo 2025

Babylon, Bitcoin Staking Mechanism and Japanese Law

Babylon, Bitcoin Staking Mechanism and Japanese Law

Staking/Restaking under Japanese Law

Staking/Restaking under Japanese Law

Crypto Regulations in Japan 2024

Crypto Regulations in Japan 2024

DAO Token Sales under Japanese Laws

DAO Token Sales under Japanese Laws

SEC ICO Warning (Dec 2017)

SEC ICO Warning (Dec 2017)

Initial Coin Offerings (ICO) under Japanese laws

Initial Coin Offerings (ICO) under Japanese laws

Guidance Note on the Japanese Virtual Currency Legislation

Guidance Note on the Japanese Virtual Currency Legislation

New Crypto Regulations of Japan

New Crypto Regulations of Japan

Impacts upon enforcement of the Act concerning Work Style Reform

Impacts upon enforcement of the Act concerning Work Style Reform

Stable Coins under Japanese Laws

Stable Coins under Japanese Laws

Libra, Maker’s Dai and other Stable Coins under Japanese Laws

Libra, Maker’s Dai and other Stable Coins under Japanese Laws

Security Token Offerings in Japan

Security Token Offerings in Japan