https://docs.babylonlabs.io/papers/btc_staking_litepaper%28EN%29.pdf?utm_source=chatgpt.com)

This article describes the structure of “Babylon,” a pioneering Bitcoin (BTC) staking project and considered the largest of its kind today, and the related issues under Japanese law.

Until now, staking has mainly taken place on Proof of Stake (PoS) chains such as Ethereum. Staking in PoS is a mechanism to increase the security of the chain by participating in the validation of transactions on the network, etc., in exchange for a reward.

In contrast, because Bitcoin employs Proof of Work (PoW), it has been believed that, in principle, there is no revenue opportunity from staking in the traditional sense of the term. The most common means of monetization using BTC has been through centralized lending services and tokenization solutions such as wBTC (Wrapped BTC).

Babylon is a project that aims to overcome these limitations of BTC utilization and realize trustless staking using BTC, and is currently one of the most popular protocols in this field. This paper examines its technical structure and issues under Japanese law.

In order to fully understand Bitcoin staking, it is helpful to have a foundational understanding of the staking mechanisms used in PoS chains, as well as the concepts of liquid staking (e.g., by LIDO) and restaking (e.g., by EigenLayer).

For more information on these topics, please refer to the following articles authored by our firm:

| (References) Our previous Article on POS chain staking (in English) ・https://innovationlaw.jp/en/staking-restaking-under-japanese-law/ Our previous Articles on POS chain staking (in Japanese) ・Organizing Legal Issues on Staking 2020.3.17 ・DeFi and the Law – LIDO and Liquid Staking Mechanisms and Japanese Law 2023.10.17 ・EigenLayer and other Restaking Mechanisms and Japanese Law 2024.5.10 |

| (1) The Babylon mechanism itself does not appear to fall under the custody regulations under the Payment Services Act (PSA). (2) The structure of Babylon is not considered to constitute a collective investment scheme (fund) under the Financial Instruments and Exchange Act (FIEA). (3) If a liquid staking provider holds custody of a user’s BTC private key, such a provider may fall within the scope of custody regulations under the PSA. Legal classification should be assessed on a case-by-case basis depending on the structure. (4) Japanese crypto asset exchanges are generally permitted to offer BTC staking services through Babylon under the current legal framework. (5) One practical issue for Japanese crypto asset exchanges is that the rewards granted through the Babylon protocol may be altcoins that are not classified as “handled crypto assets” for that exchange. In such cases, the exchange is not permitted to custody these altcoins on behalf of users under current Japanese regulations. Accordingly, alternative measures must be considered, such as (i) transferring the altcoins to the user’s unhosted wallet, or (ii) selling or swapping them via a DEX or an overseas partner, and then crediting the user with BTC or Japanese yen. |

Bitcoin uses PoW (Proof of Work), which means that staking is not possible in the same way as with Ethereum.

Babylon introduces a new mechanism that enables BTC staking, with the following key features:

| 1 BTC is staked not to secure the Bitcoin network itself, but to secure other networks that rely on PoS-like economic security mechanisms, collectively referred to as Bitcoin-Secured Networks (BSNs). 2 Rewards are determined by the secured networks, typically in the form of their native tokens. 3 BTC can be used to secure multiple such networks simultaneously, potentially increasing yield (albeit with higher associated risks). 4 Staking does not require transferring the BTC private key; instead, it is conducted in a trustless and non-custodial manner using one-time signatures (EOTS: Extractable One-Time Signatures). |

One of Babylon’s most important features is that it uses Bitcoin to enhance the security of “other” PoS networks.

The eligible networks are those that meet certain technical requirements and generally fall under the broad category of PoS-based systems—i.e., networks that have their own validator sets.

Currently, Babylon has announced test integrations and partnerships with various types of networks, including rollups, data availability (DA) chains, and oracle networks.

n a Proof-of-Stake network, security is provided by validators who stake assets—either their own or those delegated to them by third parties—to verify transactions and produce blocks.

If validators behave dishonestly, the staked assets may be slashed (i.e., partially confiscated), creating a strong financial incentive to act honestly and support the stability of the network.

In many PoS networks, delegated staking is possible, allowing token holders who do not run validators themselves to delegate their tokens to trusted validators.

In such cases, validators are responsible for the staked assets regardless of whether they are self-staked or delegated.

However, in order to participate in staking—either directly or via delegation—users must first acquire the native token of the target PoS network.

For emerging or smaller-scale networks, this presents several challenges:

Babylon aims to address these challenges by allowing Bitcoin holders to contribute to the security of such networks—collectively referred to as Bitcoin-Secured Networks (BSNs)—without requiring them to acquire the native token or transfer custody of their BTC.

Security participation is instead enabled through a trustless, signature-based mechanism.

As mentioned above, Babylon introduces a mechanism to enhance the security of PoS-based networks by leveraging BTC, an external asset, to address the inherent security limitations these networks may face.

Specifically, BTC holders contribute economic security by staking their BTC, which is used to support the security of external networks.

Importantly, this BTC collateral is not transferred directly to the PoS networks. Instead, it remains in the user’s self-managed script on the Bitcoin network, and staking is performed via the Babylon protocol through a cryptographic signature (digital proof of intent).

This design enables non-custodial and trustless participation, eliminating the need to deposit or lock up BTC with a third party.

By introducing such externally sourced security, PoS networks can leverage BTC’s high liquidity and market capitalization to reinforce their security infrastructure—without relying solely on their native tokens.

This mechanism is particularly promising for emerging PoS networks, where token distribution may be highly concentrated and the validator set small, leading to weaker security. Babylon’s BTC-based model may serve as a viable complement to address these vulnerabilities.

The rewards for staking BTC through Babylon are not paid in BTC itself, but in the native tokens designated by the PoS network that receives the security service.

From the perspective of the PoS network, this structure allows it to externally source economic security (in the form of BTC) by using its own native tokens as incentives. Through appropriate token issuance and incentive design, the network can attract BTC stakers without requiring external capital.

For BTC stakers, this provides the benefit of earning yield in the form of external PoS network tokens—without needing to transfer or wrap their BTC. This feature may present a new yield opportunity, particularly for long-term BTC holders looking to earn passive returns on their assets.

While Babylon offers BTC holders the opportunity to earn yield, there are several risks associated with the fact that rewards are paid in the native tokens of external PoS networks rather than in BTC.

This structure may also present practical and regulatory challenges, especially for users staking through crypto asset exchanges in Japan. As discussed in Section IV-3 below, it could act as a disincentive for such platforms to offer Babylon staking services.

| Risks Associated with Receiving Rewards in Other Tokens • Price Volatility Risk of Reward Tokens The reward tokens received from PoS networks generally have lower market capitalization and liquidity compared to BTC, making them more susceptible to price volatility. Even if the nominal reward amount is high, a sharp decline in the token price could result in a significantly reduced effective yield. • Liquidity and Redemption Risk If the reward tokens are issued by a relatively niche or illiquid chain, they may be difficult to redeem on the open market, or suffer from large bid-ask spreads, reducing the actual profitability of staking. • Continuity and Stability of Reward Design If the PoS network changes its reward policy or reduces incentives in the future, the economic appeal of Bitcoin staking may diminish. Moreover, if the chain’s operations are unstable, there is a risk that rewards may not be distributed properly or consistently. |

Babylon is designed to allow BTC holders to participate in network security as providers of economic collateral—autonomously and non-custodially, without transferring their private keys to any third party.

This architecture enables truly trustless staking, eliminating the need for traditional asset transfers or reliance on custodians.

In conventional staking and DeFi use cases, utilizing crypto assets typically requires one of the following actions:

Both methods effectively require giving up control of the private key, at least temporarily, which introduces risks such as asset leakage or loss due to smart contract vulnerabilities.

Babylon avoids these risks by enabling signature-based staking mechanism. This allows BTC holders to retain full control over their assets while still participating in economic security provision.

Babylon utilizes a cryptographic technique known as Extractable One-Time Signatures (EOTS) to allow BTC stakers to both prove their ownership of BTC and explicitly accept responsibility for contributing to the security of a PoS-based system.

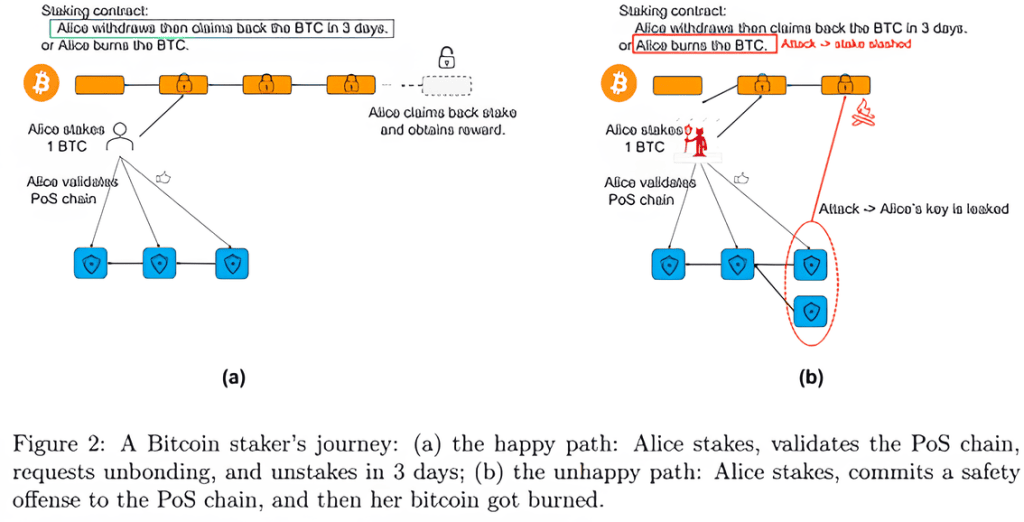

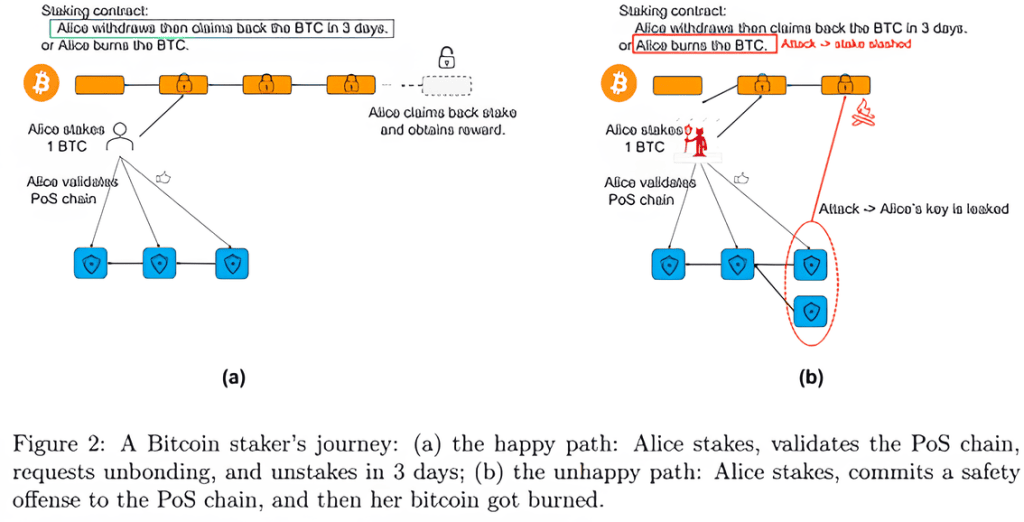

The basic flow of this mechanism is as follows:

| 1.The BTC staker selects a finality provider and generates the transaction data necessary to initiate staking. 2.The transaction includes the following conditional clauses: (i) The designated BTC cannot be transferred for a fixed period (e.g., three days); (ii) If certain predefined conditions arise during that period, the BTC will be sent to a predetermined address (typically a burn address); (iii) However, the BTC staker retains the right to cancel (revoke) the transaction at any time before the fixed period ends, as long as no slashing condition has been triggered. 3.The “predefined conditions” referred to in (ii) generally correspond to slashing events—e.g., if the selected finality provider engages in dishonest behavior (such as submitting double signatures), the BTC will be forcibly sent to the burn address as a penalty. 4.The BTC staker finalizes the process by signing the transaction using a one-time EOTS (Extractable One-Time Signature), thereby proving BTC ownership and formally declaring their intent to participate in security provision. |

This design enables PoS networks to receive a security guarantee backed by BTC, a highly liquid external asset, while the Babylon protocol itself provides a comprehensive framework for detecting malicious behavior and executing slashing penalties.

The BTC staking mechanism enabled by Babylon is characterized by a trustless and non-custodial architecture, in the following respects:

This structure, which minimizes the need for trust in third parties, is closely aligned with Bitcoin’s foundational principles of self-custody and decentralization.

However, it is important to note that the system is not entirely “trustless.”

Certain functions—such as verifying signatures, executing slashing, and distributing rewards—are handled by the Babylon Genesis Chain, described below.

In other words, while BTC itself is never directly deposited or locked up, a degree of “protocol trust” is still required—specifically, trust in the legitimate operation and correct implementation of the Babylon protocol, including the Babylon Genesis Chain.

The entities involved in the Babylon ecosystem are diverse, but some of the key participants include following:

Figure: Babylon Overview

• Summary:

Bitcoin-Secured Networks (BSNs) refer to a category of networks (or chains) that enhance their security by integrating Bitcoin’s economic security via Babylon. These networks typically operate on PoS or PoS-like systems and utilize BTC as external collateral to strengthen their security infrastructure.

• Role:

PoS networks, particularly in their early stages, often face security challenges due to a small or overly centralized validator set and insufficient economic collateral. By incorporating BTC through Babylon, BSNs can achieve the following:

• Typical Use Cases (Examples):

• Summary:

Entities that observe and verify block finality on PoS networks secured by Babylon, and submit cryptographic finality signatures accordingly.

• Role:

• Note:

Finality providers differ from traditional validators in other chains. Their core responsibility is to observe the finality of blocks on the target PoS network and report that information to the Babylon chain.

However, they play a somewhat validator-like role in that they create and submit cryptographic signatures, earn rewards for doing so, and are subject to slashing in case of misconduct.

Comparison of Finality Providers and General PoS Validators

| Item | Finality Provider (Babylon) | General PoS Chain Validator |

| Block Generation | ❌ Not performed | ✅ Performed |

| Finality Observation | ✅ Performed | ❌ Typically not involved (finality is emergent) |

| Signature Type | ✅ Signs finality data | ✅ Signs blocks and voting messages |

| Slashing Risk | ✅ Yes (for fraudulent finality signatures) | ✅ Yes (for double signing, downtime, etc.) |

| Reward Mechanism | ✅ Yes (based on submitted signatures) | ✅ Yes (based on block production and delegation) |

• Role:

Hold BTC and contribute to the security of PoS networks by submitting off-chain cryptographic signatures to Babylon.

• Reward:

Receive staking rewards from the PoS networks in return for providing BTC as collateral via Babylon.

• Key Characteristics:

BTC stakers can also delegate their staking to finality providers.

Even in such cases, no BTC or private key is transferred, and the delegation is completed through a non-custodial mechanism.

| Function | Description |

| Signature Verification | Receives and verifies signatures from BTC stakers and finality providers. |

| Slashing Enforcement | Executes slashing penalties when fraudulent or malicious signatures are detected. |

| Finality Recording | Records the finality of blocks from PoS networks on Bitcoin (e.g., via timestamping). |

| Cross-Chain Relay | Relays verified security information and signatures to other BSNs. |

A protocol that facilitates BTC staking via Babylon on behalf of BTC holders, aiming to improve operational efficiency, usability, and liquidity. While the main focus is on liquid staking, a hybrid model that combines restaking (reuse of the same BTC for multiple networks) may also be adopted where appropriate.

| Key functions: (i)Streamlining Operations Since it is burdensome for BTC holders to individually generate signatures and monitor activity across multiple PoS networks, the protocol handles the following tasks: ・Selection of PoS networks for staking ・Automatic generation and management of EOTS signatures ・Collection and distribution of staking rewards (ii) Issuance and Utilization of Liquid Staking Tokens (LSTs) The protocol issues liquid staking tokens (e.g., stBTC) backed by the user’s staked BTC position. This allows the user to retain liquidity of their assets even while staking, enabling secondary use in DeFi and other ecosystems. (iii) Complementary Use of Restaking By carefully managing risk, the protocol may reuse the same BTC signature across multiple PoS networks (i.e., multi-staking), thereby maximizing yield. |

The relationship between the Babylon ecosystem and the Babylon Genesis Chain is nuanced and may require clarification.

The Babylon Genesis Chain is a PoS Layer 1 blockchain that plays a central role within the Babylon ecosystem. However, it is not synonymous with the ecosystem itself.

The Babylon protocol refers to a broader framework encompassing multiple Bitcoin-Secured Networks (BSNs) that utilize Bitcoin-based economic security via Babylon.

If a participant joins Babylon as a finality provider and provides finality to the Babylon Genesis Chain, they receive “BABY”, the native token, as a reward.

Finality providers currently serve the Babylon Genesis Chain, where they contribute to finality and receive BABY, the native token, as compensation. Although the Babylon protocol is designed to be extendable to other Bitcoin-Secured Networks (BSNs), finality provisioning beyond the Genesis Chain has not yet been implemented. In the future, other BSNs may adopt the Babylon finality mechanism and offer their own tokens as rewards to finality providers.

In addition, the Babylon Genesis Chain has its own set of validators, who stake BABY and participate in block production and consensus. These validators are also rewarded in BABY for their contributions to the network’s operation.

| Item | Details |

| Token Name | BABY (Native token of the Babylon Genesis Chain) |

| Means of Acquisition 1 | Stake BABY and participate as a validator in block production and validation on the Babylon Genesis Chain |

| Means of Acquisition 2 | Provide finality to the Babylon Genesis Chain using BTC as a finality provider |

| Primary Use Case 1 | Staking collateral for validator participation |

| Primary Use Case 2 | Governance (proposal creation and voting rights) |

| Primary Use Case 3 | Network fees (planned in the future) |

| Additional Notes | Rewards in other BSNs are typically paid in each BSN’s own native token, not BABY |

| Item | Finality Provider | Validator (Babylon Genesis Chain) |

| Staked Asset | BTC (non-custodial) | BABY token (non-custodial) |

| Primary Role | Provide finality (submit signatures) to BSNs | Block production and validation on Babylon Genesis Chain |

| Target Chain(s) | Babylon Genesis Chain and other BSNs | Only the Babylon Genesis Chain |

| Reward Token | BABY or BSN-native token (depending on the chain) | BABY token |

| Slashing Risk | Signature invalidation and BTC burn (e.g., double signing) | Slashing of staked BABY (e.g., double signing or downtime) |

| Staking Method | Declaration of intent via BTC signature (held in a self-managed script; delegation also possible) | On-chain BABY token staking (self-custodied; delegation also possible) |

Based on the above assumptions, this section outlines the key legal issues related to providing or using a Bitcoin staking service such as Babylon.

In particular, the analysis focuses on two core questions:

In the context of BTC staking via Babylon, a key legal issue is whether the provision of BTC as economic security constitutes the “management” or “custody” of crypto assets under Japanese law.

Under custody regulations based on the Payment Services Act, the primary legal criterion is generally understood to be whether the service provider holds the private key required to transfer the user’s crypto assets.

This interpretation is supported by an official public comment issued in connection with the 2019 amendments to the Act:

“If a business operator does not possess any of the private keys necessary to transfer the cryptographic assets of a user, the business operator is not considered to be in a position to proactively transfer the cryptographic assets of the user, and therefore, basically, is not considered to fall under the category of ‘managing cryptographic assets for others’ as stipulated in Article 2, Paragraph 7, Item 4 of the Payment Services Act.”

In this regard, the private key required to transfer BTC is never shared with or transferred to any entity, including the Babylon Genesis Chain or finality providers.

The technical structure of the system is as follows:

This design enables BTC to serve as economic security without transferring control of the private key, ensuring that the BTC remains in the staker’s custody unless slashing conditions are triggered.

Accordingly, Babylon and finality providers would generally not be considered to fall under custody regulations under the Payment Services Act.

However, it should be noted that certain Liquid Staking Protocols may offer services that involve taking custody of users’ private keys. In such cases, those entities may indeed be subject to custody regulations, and a case-by-case legal assessment would be required.

In Babylon, BTC is provided as economic security, and BTC stakers receive compensation while bearing certain risks such as slashing. From this structure, a legal question arises as to whether Babylon might be classified as a “fund” (collective investment scheme) under Japanese law.

Article 2, Paragraph 2, Items 5 and 6 of the Financial Instruments and Exchange Act (“FIEA”) broadly define a “fund” (collective investment scheme) as follows:

| (A)Covered Forms of Rights (any of the following): 1. Partnership agreement 2. Silent partnership agreement 3. Investment limited partnership agreement 4. Limited liability partnership agreement 5. Membership rights in a general incorporated association 6. Other similar rights (excluding those established under foreign laws) Note: Items 1–5 are illustrative; “other rights” are interpreted broadly, regardless of legal form. (B)Description of the Scheme (all of the following must be satisfied): ・Investors contribute cash or assets (including crypto assets, per Cabinet Order); ・The contributions are used in a business; and ・Investors have rights to receive dividends or a share in the property derived from that business. (C)Exclusions: The scheme does not apply where all investors are actively and substantially involved in the business (per Cabinet Order requirements); or Where investors are entitled to returns only up to the amount they invested (limited liability form). (D)Foreign Funds: Similar rights based on foreign laws may also be regulated under separate provisions. |

While Babylon might fall within the category of “other similar rights” in (A) above and does not appear to meet the exclusions under (C), it is unlikely to satisfy all of the conditions under (B). Accordingly, it may not constitute a fund under the FIEA, for the following reasons:

From these perspectives, Babylon’s BTC staking mechanism does not appear to meet the definition of a fund under the FIEA.

Babylon allows BTC stakers to delegate their staking authority to finality providers. However, since this process does not involve the transfer of private keys, such delegation is not likely to fall under a fund regulation.

On the other hand, certain Liquid Staking Protocols may offer services that involve taking custody of users’ private keys. In such cases, a careful legal analysis is required to determine whether such schemes meet the definition of a fund under the FIEA, particularly in light of the structure of asset control and contribution.

This section examines the legal and operational issues that may arise when a Japanese crypto asset exchange operator performs BTC staking via the Babylon protocol using assets deposited by users.

Many crypto asset exchanges in Japan provide staking services as part of their business operations.

To our understanding, as long as users do not bear the risk of slashing (i.e., potential loss)12, such services are generally treated as part of the core business of “receiving deposits of crypto assets” as defined in Article 2, Paragraph 15, Item 4 of the Payment Services Act.

This legal interpretation should remain applicable even when Babylon is used as the underlying protocol—no special legal treatment or additional licensing is expected to be required.

Under Article 60-11, Paragraph 2 of the Payment Services Act and Article 27, Paragraph 3, Item 1 of the Cabinet Office Ordinance on Crypto Asset Exchange Services, crypto asset exchanges in Japan are required to segregate users’ crypto assets from their own assets and hold them in cold wallets.

In most PoS staking systems, private keys used for asset transfers do not need to be moved; rather, a separate validator key is used. This practice is generally considered not to conflict with cold wallet requirements.

In Babylon, there is no concept of a validator key. Instead, staking is performed via cryptographic signatures called Extractable One-Time Signatures (EOTS). Importantly, the private key for BTC remains in the possession of the BTC staker—in this case, the exchange operator—and is never transferred or exposed to third parties.

Therefore, since the exchange does not move or manage private keys externally, Babylon staking is not expected to conflict with cold wallet custody obligations.

A unique practical issue with Babylon staking is that while BTC is used as the staked asset, the rewards are typically paid in the native tokens (i.e., altcoins) of the target PoS network, rather than in BTC itself.

For example, when staking ETH, both the staked asset and the reward are ETH, which poses no legal or operational issues for exchanges that have already registered ETH as a “handled crypto asset” with the Financial Services Agency (FSA).

In contrast, when staking BTC via Babylon, the resulting rewards may be in the form of tokens such as BABY or other native tokens of PoS networks that are not registered as handled crypto assets. This presents a compliance challenge under the Payment Services Act.

Several operational approaches can be considered:

In this approach, the exchange holds the altcoins it receives as rewards and allocates them to users.

While it may be possible to register certain major tokens (e.g., BABY) as handled crypto assets, and some tokens associated with Babylon partner networks (e.g., ATOM, SUI) are already listed in Japan, it is not realistic to file individual registrations for every potential reward token.

Here, the exchange does not custody the reward tokens but transfers them directly to each user’s self-managed wallet. This bypasses the need to register the tokens as handled crypto assets.

However, this approach presents practical challenges: requiring users to manage wallets for a wide range of altcoins is burdensome from both a UX and operational support perspective. It also introduces potential transaction costs and operational risks.

Under this method, the exchange converts the reward altcoins into BTC or JPY (e.g., via a DEX or an overseas partner), and then distributes those converted assets to users as rewards.

While this may raise concerns that the exchange is engaging in crypto asset exchange services involving unregistered crypto assets, such risks may be mitigated through appropriate contractual arrangements.

Specifically, if the agreement with the user clearly states that:

then the exchange’s sale or swap of the altcoins can be viewed as part of its internal process for sourcing rewards, rather than as a crypto asset exchange activity involving third parties.

In this structure, the exchange merely acquires and disposes of unregistered tokens on its own account, which is generally not considered a regulated activity under current law.

In light of the above, under the current regulatory framework, it appears that the most realistic and effective approach for crypto asset exchanges is to structure their operations based on scheme (3).

That said, from the perspective of BSNs, there are concerns about potential ongoing selling pressure caused by continuous liquidation of reward tokens. Therefore, the sustainability of the system as a whole should also be carefully considered in future discussions.

Acknowledgments

In preparing this article, I received valuable input from the teams at Kudasai Inc. and Next Finance Tech Inc., both of whom are well-versed in Babylon staking. I also benefited from informal yet insightful suggestions from individuals involved with the Babylon protocol.

However, any remaining errors or interpretations are entirely my own and do not represent the official views of any specific entity

Disclaimer

The content of this document has not been reviewed by any regulatory authority and represents a general legal analysis based on interpretations currently considered reasonable under applicable Japanese law. The views expressed herein reflect the current thinking of our firm and are subject to change without notice.

This document does not constitute an endorsement of any specific staking mechanism, including Bitcoin staking, the Babylon protocol, liquid staking services, or any related technologies or platforms.

This material is provided solely for informational and blog purposes. It does not constitute legal advice, nor is it intended to be a substitute for legal counsel. For advice tailored to your specific circumstances, please consult with a qualified attorney.

As seen in Ethereum network, staking—the process of locking a certain amount of crypto assets on a blockchain for a set period to contribute to transaction validation (Proof of Stake), earning rewards in return—is gaining traction globally as well as in Japan. Major Japanese crypto asset exchanges now offer staking services, contributing to its expansion. This paper outlines key legal issues related to staking under Japanese law and briefly addresses the concept of restaking, which is a mechanism in which existing staked crypto assets or staking rewards are staked again to earn additional rewards, with the aim of enhancing network security and enabling new services.

Regulatory applicability depends on the manner in which staking is conducted and its legal framework. Relevant regulations include those governing Crypto Asset Exchanges and Funds as referenced and further explained below.Staking one’s own crypto assets remains unregulated under such regulations, therefore, this discussion focuses on cases where a service provider stakes on behalf of users. To summarize the key conclusions in advance:

| Staking Structure and Legal Framework | Applicability of Crypto Asset Exchange Regulations / Fund Regulations as per Japanese Law |

| Service provider does not receive the user’s private key (only delegation) | No applicable regulations |

|

Service provider gets the user’s private key |

|

| Legal structure: “Custody” | Crypto Asset Exchange regulations apply (registration as a Crypto Asset Exchange) |

| Legal structure: “Investment” | Fund regulations apply (registration as a Type II Financial Instruments Business Operator) |

| Legal structure: “Lending” | No applicable regulations |

Custody, Investment, and Lending are key legal classifications in the regulatory framework for staking services. While details will be discussed later, these terms can be briefly defined as follows:

✓Custody refers to the management of crypto assets on behalf of users. Possession of private keys is a key factor in determining regulatory applicability of Custody. If structured as Custody, it falls under Crypto Asset Exchange regulations under the Payment Services Act (PSA).

✓Investment refers to a scheme where users contribute funds (including crypto assets) to a service provider, which then utilizes them for business operations (e.g., staking) and distributes profits to the users. If structured as Investment, it falls under Fund regulations governed by the Financial Instruments and Exchange Act (FIEA).

✓Lending refers to an arrangement where users lend their crypto assets to a service provider, which manages the crypto assets at its discretion and returns them after a specified period. If recognized as a Lending agreement, it is generally not subject to PSA or FIEA regulations.

Under Japanese law, Crypto Asset Exchange regulations under the PSA, Article 2, Paragraph 15, apply to the following activities:

Among these, staking is particularly relevant to Item 4., which refers to the Custody services.

Regarding “managing crypto assets on behalf of others” (hereinafter referred to as “Custody”), the Financial Services Agency (FSA) guideline3 states:

“[…] in a case where the business operator is in a state in which the business operator is able to proactively transfer a Crypto-Asset of a user, such as a case where the business operator holds a secret key [Author’s Note: referring to a private key] sufficient to enable the business operator to transfer the Crypto-Asset of the user without any involvement of the user, either alone or in cooperation of an affiliated business operator, such a case falls under the management of Crypto-Assets.”

This indicates that possession of private keys is a key factor in determining regulatory applicability of Custody.

Additionally, staking may also be subject to Fund regulations governed by FIEA (Article 2, Paragraph 2, Item 5). This FIEA applies where users contribute funds (including crypto assets) to a service provider, which then utilizes them for business operations and distributes profits to the users.

If a service provider only receives delegation from users without holding their private keys4, it does not qualify as a Custody activity under the FSA guideline as quoted above and is not subject to Crypto Asset Exchange regulations under the PSA.Additionally, in this case, since users do not contribute funds to the service provider —given that the service provider cannot transfer the crypto assets for business operations without possessing the private key— it does not constitute an “Investment” and therefore, Fund regulations under the FIEA do not apply either.

If a service provider holds the user’s private key, it may be classified as a Custody activity under the PSA. Additionally, depending on the legal structure of the arrangement, the user’s contribution could be considered an “Investment,” making it subject to Fund regulations under the FIEA.

First, if the arrangement is structured as a “Custody,” the provider is deemed to be managing the user’s crypto assets on their behalf. This qualifies as a Custody activity under Crypto Asset Exchange regulations and falls under the Payment Services Act (Article 2, Paragraph 15, Item 4).

If the legal structure is such that the provider receives “Investment” of crypto assets from users, it does not meet the Custody regulation requirement of “managing crypto assets on behalf of others,” as the assets are received for business use rather than for custodial management on behalf of users. Therefore, Custody regulations under the PSA do not apply. However, since the provider uses the contributed funds to operate a business (staking) and distributes the revenue to users, it is likely subject to Fund regulations under FIEA.

If the arrangement is structured as Lending, where the user lends crypto assets to the service provider, which manages them at its discretion and returns them after a specified period, rather than making a Custody (where assets are held and managed on behalf of the user) or an Investment (where assets are contributed with an expectation of return), no specific regulations apply. However, according to the aforementioned FSA guideline5, “The borrowing of Crypto-Assets […] falls under the management of Crypto-Assets […] if a business operator substantially manages a Crypto-Asset on behalf of another person under the name of the borrowing of a Crypto-Asset such that the user can receive the return of the Crypto-Asset borrowed at any time at the request of the user. “

Therefore, regulatory authorities may classify such circumvention schemes as a Custody activity, making them subject to Custody regulations under the PSA.

Thus, even when a service provider holds the user’s private key and conducts staking, the applicable regulations vary depending on the legal structure of the arrangement. However, in practical business operations, the distinction between “Custody”, “Investment” and “Lending” is not always clear. To determine the applicable regulations, it is useful to analyze the staking scheme based on the following factors:

Based on these factors, the conclusions for typical cases are summarized as follows. However, if a case does not fit within these typical scenarios, determining whether it qualifies as Custody service or a Fund Investment can be challenging.

The licenses required for service providers under each scheme are summarized as follows:

Restaking is a scheme where crypto assets that have already been staked are staked again in another protocol.

The demand for restaking arises from two key factors: enhance security of certain decentralized finance (DeFi) protocols and similar services and enabling users to obtain higher yields.

If a DeFi service uses its own Proof of Stake token for validation of transactions and hence its security, its effectiveness may be limited due to low token value or poor distribution and can be open to security vulnerabilities through holding a significant number of the related tokens. Restaking solves this by reusing staked crypto assets (e.g., ETH) to provide the security of major public blockchains like Ethereum.

In return, DeFi services share rewards with crypto assets holders, who also bear slashing risks. This allows holders to earn additional rewards on top of their staking returns, boosting overall yields.

The key legal issues related to restaking under Japanese law include:

Regarding Custody regulations, the applicability of Custody regulations depends on the structure of the restaking service. However, based on the previously mentioned stance of the FSA on Custody, if the crypto assets are managed by a smart contract and the restaking service provider does not have the technical ability to transfer the crypto assets, Custody regulations would not apply.

Regarding Fund regulations, the application of Fund regulations requires that the contributed assets be used to conduct a business. In the case of restaking, if crypto assets are merely locked as a form of collateral to cover potential penalties from slashing, rather than being allocated for business operations, it would not meet the legal definition of an Investment. Therefore, Fund regulations would not apply.

Note that, as with staking, the applicable regulations may vary depending on the specific structure of the restaking scheme.

This article describes the structure of and applicable Japanese law to liquid staking, which has been expanding rapidly in recent years, and its most significant protocol, LIDO.

| (1) To analyze liquid staking, it is generally necessary to consider (1) the sales, purchase, and exchange regulations of the Payment Services Act (We call crypto regulation in the Payment Services Act the “Crypto Assets Act” after this), (2) the custody regulations of the Crypto Assets Act, and (3) the fund regulations of the Financial Instruments and Exchange Act, which is a kind of Japanese Security Act (the “FIEA”). (2) For staking, LIDO accepts staking of ETH and issues stETH in exchange for staked ETH. We believe that this conduct is not considered as “sales, purchase, or exchange of crypto asset” in the terms of the Crypto Assets Act. We believe stETH is just issued as proof of staking and not “exchange” under the Japanese Civil Code. (3) If the staking of ETH is considered a custody of crypto assets, the custody regulation of the Crypto Assets Act may apply. However, if the deposit is made against a smart contract and the protocol or node operator is technically incapable of transferring the ETH, etc., the custody regulation does not apply. (4) The most controversial question should be whether the fund regulations of the FIEA would apply to liquid staking. LIDO’s mechanism might be considered as a fund because (i) ETH, etc., is contributed to the protocol by a user of LIDO, (ii) the node operator manages it, (iii) a portion of the staking fee is distributed to the user, (iv) the user seems to bear the penalty risk and thrashing risk of the staking, and (v) this mechanism seems to like a fund. However, we believe that we can argue that the fund regulation will not apply to LIDO because (i) staked ETH itself is not converted to anything, (ii) it is used for just a kind of collateral to compensation to penalty/slashing, and (iii)we can argue this mechanism is entirely different from usual funds. (5) In addition to the above, we can argue that the Japanese financial regulation might not apply to DeFi if there is no “operator” because Japanese law just regulates persons and legal persons. However, this argument needs an actual fact analysis of the relevant liquid staking. Further, this argument cannot apply to a person or legal entity, if any, who intermediate Japanese residents to DeFi. Thus, the arguments from (1) to (4) above are important. |

Liquid staking is a DeFi (decentralized finance) mechanism whereby a person receives a staking fee for a crypto asset while receiving an additional alternative asset (a staking-proof token) and can invest said alternative asset in another DeFi.

Proof of Stake (POS) is the authentication mechanism of the blockchain by a person who has a certain level of involvement (stake) in the crypto asset.

Unlike the Proof of Work (POW) mechanism used in Bitcoin and other cryptocurrencies, authentication can be performed without requiring a large amount of calculations, thus reducing electricity consumption and making it more environmentally friendly.

Ethereum has been structured using POS instead of POW from ETH 2.0. In Ethereum staking, (1) you can become a validator by depositing 32 ETH, (2) the validator authenticates each transaction on Ethereum and thereby receives a certain amount of ETH as a reward, and (3) if the validator intentionally provides false information, he/she will be penalized by forfeiting a part of the deposited ETH (thrashing), (4) a validator is always required to be online, and if they are down, they will also be penalized to a certain extent.

LIDO is the world’s largest protocol for Liquid Staking. At present, it is estimated that more than 30% of the staking volume of Ethereum is done via LIDO. LIDO is supposed to work as follows:5

Prepared by So&Sato Law Offices from published materials

①LIDO allows users to stake ETH without maintaining their staking infrastructure and without economically locking up their assets.

②When a user wants to stake ETH to LIDO, the user should send ETH to LIDO’s smart contract. In response, the user receives a 1:1 token called stETH.

③stETH is a token that represents the deposit of ETH to LIDO for staking, and when a user sends stETH to LIDO to burn stETH, the user will receive ETH. stETH can be freely bought and sold, and if there is another DeFi that accepts stETH, the user can earn double rewards by using stETH on another DeFi (however, DeFi protocols that accept stETH still seem to be limited).

④LIDO will use ETH received through the smart contract to perform staking. LIDO will receive 10% of the reward obtained from staking, which will be distributed to the person in charge of the staking (node operator) and the LIDO DAO. The remaining 90% will be distributed to the users. The distribution to the users is made by adding the number of stETH in the address of stETH, and the number of ETH managed by LIDO is always the same as the number of stETH.

⑤LIDO uses multiple node operators. Node operator candidates apply to LIDO, stating that they wish to become node operators, their experience and technical capabilities, etc., and are then voted on by the DAO, which is composed of LIDO token holders, the LIDO’s governance tokens, to determine whether they are eligible to become node operators.

⑥Note that ETH has thrashing risks and penalties. LIDO hedges against such risks by using a large number of node operators. LIDO also manages some ETH separately and uses it as insurance against thrashing risk.

⑦LIDO is an open-source, peer-to-peer protocol and is not operated by a single operator, etc., as the LIDO DAO makes the decision on its operation.

When offering liquid staking like LIDO, it is necessary to consider whether the trading and custody regulations of the Crypto Assets Act apply and whether the fund regulations of the FIEA apply.

When a user contributes ETH to LIDO, the user will receive stETH, and conversely, when a user sends stETH to LIDO, the user will receive ETH.

The question arises as to whether this action constitutes an exchange of ETH for stETH. If it is considered an exchange of crypto assets, the regulations of the crypto asset exchange services might apply.

StETH, however, is issued to prove the deposit of ETH, and we believe the issuance of such stETH does not constitute a sale or exchange under civil law and thus does not constitute an exchange of crypto assets (and vice versa).

The contribution of ETH to LIDO might be considered a deposit of crypto assets to LIDO and raises the issue of whether the custody regulations of the Crypto Assets Act apply to LIDO.

However, it appears that the contribution to LIDO is a contribution to a smart contract, and LIDO cannot use said ETH except for staking (i.e., it does not control the private key) due to the structure of the smart contract.

Under the Japanese custody regulations, “If a business operator does not possess any of the private keys necessary to transfer the crypto assets of a user, the business operator is not considered to be in a position to proactively transfer the crypto assets of the user. In such case, the business operator is basically not considered to fall under the category of “managing crypto assets for others” as defined in Article 2.7.4 of the Payment Services Act. (Result of Public Comment No. 9 on the Draft Cabinet Order and Cabinet Office Ordinance Concerning Amendment to the Payment Services Act, etc. of 2019). If the smart contracts can technically prevent the free transfer of ETH by people related to LIDO, we believe LIDO is not considered to be subject to the custody regulations under the Crypto Assets Act.

The question arises whether LIDO or liquid staking is considered a fund (collective investment scheme), given the mechanism of receiving ETH contributions, the node operator managing it, distributing a portion of staking fees to users, and users bearing the risk of thrashing and other penalty risks.

The definition of a fund under Japanese law is generally as follows (Article 2, Paragraph 2, Items 5 and 6 of the FIEA). If a fund investor’s right is tokenized, the tokens are considered electronically recorded transferable rights (Article 2, Paragraph 3, Pillar 1 of the same law).

If the issuer itself is offering or private offering the tokens, registration as a Type 2 Financial Instruments Business is required (Article 2, Paragraph 8, Item 7, (g), Article 28, Paragraph 2, Item 1, and Article 29 of the same law, Article 1-9-2, Item 2 of the Order for Enforcement of the FIEA), and if the third party is offering or private offering the tokens, registration as a Type 1 Financial Instruments Business is required (Article 28, Paragraph 1, Item 1 and Article 29 of the FIEA).

| Definition of the Funds under Japanese law (A) (i) partnership contracts, (ii) silent partnership agreements, (iii) limited partnership agreements for investment, (iv) limited liability partnership agreements, (v) membership rights in incorporated associations, and (vi) other rights (excluding those under foreign laws and regulations). (B) The Investor(s) receives the right to receive dividends of income or distribution of properties that arise from a business conducted by using money (including crypto assets) invested or contributed by the investor(s). (C) None of the following (a) the case where all of the investors are involved in the business subject to the investment (in the way specified by a Cabinet Order) (b) the case where the investor(s) shall not receive dividends or principal redemption more than their investment Funds under Foreign Law (D) Rights under foreign laws that are similar to the above rights. |

The concept of “other rights” in (A) above is very broad, and it is said that (i) through (v) are merely an enumeration of examples, regardless of the legal form. It can be argued that tokens issued in fully decentralized finance are not “rights” because they are not considered “rights” in the usual legal interpretation, but there is currently a prevailing view that some rights are recognized for Bitcoin, etc.6, and in relation to this article, we assume that some kind of right is recognized even for smart contracts.

Nor does it fall under any of the exceptions in (C) above.

The main issue is the interpretation of (B) above, which states “dividends of income or distribution of properties that arise from a business conducted by using money” and “invested or contributed.” If we simply take the point that ETH is sent to the smart contract, it is used in the business of the POS, and the award from staking ETH is distributed to users, it would seem to satisfy both the “dividends of income or distribution of properties that arise from a business conducted by using money,” and “invested or contributed” requirement.

However, liquid staking is very different from ordinary funds in the following respects, and, arguably, liquid staking is not a fund to which the FIEA applies.

(1)In the case of a regular fund, the money and other assets contributed are fully owned by the fund operator, and the fund operator can technically use them in various ways, although they are contractually bound. In the case of liquid staking, the ETH contribution is made to the smart contract, and LIDO or node operators are not free to use it; ownership (ownership-like rights) over ETH is always considered to be held by the user,

(2)In the case of a regular fund, the money received is used to purchase shares, fund a business, etc., and changes from money to shares, etc. In LIDO staking, the ETH sent to the smart contract is not specifically changed into anything else but is maintained as it is.

(3)The only reason ETH is locked is to ensure that there is no thrashing in the event of fraudulent reporting in the validation process or penalties if a node goes offline.

(4)Based on (1) through (3) above, if we compare the legal nature of staking to a traditional economic act, it can be thought that the user is merely locking ETH into a smart contract as a kind of collateral to secure default liability and is merely receiving compensation for providing third party collateral. The provision of such collateral and the receipt of compensation do not satisfy the requirements of “dividends of income or distribution of properties that arise from a business conducted by using money” and “invested or contributed,” as referred to in the fund.

In the case of DeFi, it could be argued that the operator does not exist in the first place and is not subject to regulation. Japanese law is a legal system that regulates persons and legal entities, such as operators. A completely decentralized financing scheme would not be subject to regulation. However, we need to carefully consider whether there really is no operator for DeFi. In general, DeFi aims for the operator to be non-existent, but even so, it is unclear whether many DeFi are truly completely operatorless.

Further, if the scheme is subject to financial regulations under the law, assuming there is an operator, the intermediary for the scheme could be subject to regulations even if there is no operator for DeFi itself. It would prevent, for example, an unlicensed Japanese company from sending customers to the DeFi.

Therefore, when examining the legal issues of DeFi, it is necessary to consider two issues: (i) if there is an operator, whether it is subject to legal regulation, and (ii) whether an operator exists.

However, it is unclear from the published documents whether the LIDO DAO is truly decentralized, so this article mainly discusses (i) above.

Disclaimer

The content of this article has not been confirmed by the relevant authorities or organizations mentioned in the article but merely reflects a reasonable interpretation of their statements. The interpretation of the laws and regulations reflects our current understanding and may, therefore, change in the future. This article does not recommend the investment in LIDO or liquid staking. This article provides merely a summary for discussion purposes. If you need legal advice on a specific topic, please feel free to contact us.