Category Archives: Uncategorized

Ⅰ Introduction

Recently, Web3 companies often ask us whether they can issue and sell tokens linked to ownership or value of real world assets (“RWA tokens”) in Japan. The types of linked real assets include artwork, real estate, whiskey, vintage cars, government bonds, securities, gold, etc.

Applicable Japanese regulations to RWA tokens vary depending on the types of tokenized assets and the scheme. We will provide an overview of the applicable regulations to RWA tokens and then substantive legal issues of RWA tokens.

Ⅱ Crypto Regulation

Japanese law differentiates crypto assets, which are regulated, and NFTs, which are not regulated, and most RWA tokens are structured as NFTs.

If RWA tokens fall under the category of crypto assets, selling and purchasing the tokens as a business requires a crypto asset exchange license. For example, Zipang Coins, which are RWA tokens representing gold and issued by a Japanese major trading company group, are structured as crypto assets, and only licensed exchanges can sell them as a business.

On the other hand, most RWA tokens are structured as NFTs. From the legal viewpoint, the difference between crypto assets and NFTs is whether they can be used as a payment method. FSA has submitted a guideline and answers to public comments and stated that if tokens satisfy the following requirements, they are not crypto assets and are not regulated under the Payment Service Act.

| Required Factors to be considered as not regulated Crypto Asset but non-regulated NFTs (i) the use as a means of payment to unspecified persons is prohibited, and (ii-a) the number of issued tokens is less than 1 million, or (ii-b) the transaction price is more than JPY 1,000. |

Ⅲ Fund Regulation

If RWA tokens are considered securities, to sell and purchase the tokens as a business requires a financial instruments business operator license. If the token holder has the right to receive a dividend or more than 100% principal redemption, they are generally considered securities. The definition of the collective investment scheme (fund) in Japan is as follows. As the definition covers “all rights” that can receive a dividend or more than 100% principal redemption, you should carefully analyze whether the tokens are considered securities when its structure includes a profit distribution element.

| Definition of the Funds under Japanese law (A) (i) partnership contracts, (ii) silent partnership agreements, (iii) limited partnership agreements for investment, (iv) limited liability partnership agreements, (v) membership rights in incorporated associations, and (vi) other rights (excluding those under foreign laws and regulations). (B) The Investor(s) receives the right to receive dividends of income or distribution of properties that arise from a business conducted by using money (including crypto assets) invested or contributed by the investor(s). (C) None of the following (a) the case where all of the investors are involved in the business subject to the investment (in the way specified by a Cabinet Order) (b) the case where the investor(s) shall not receive dividends or principal redemption more than their investment (D) Funds under Foreign Law (rights under foreign laws that are similar to the above rights) |

Ⅳ Goods Deposit Transaction Regulation

Another regulation that is related to RWA tokens is the Goods Deposit Transaction regulation. In Japan, there have been some controversial transactions in which (i) a merchant sells some goods to buyers, (ii) the merchant accepts deposits of the sold goods from the buyers for more than 3 months, and (iii) the merchant promises to pay some fee such as a rental fee to the buyers or promises to buy-back the sold products more than the sales price. These kinds of transactions were often used as financial investments without regulation. The Goods Deposit Transaction regulation now regulates these kinds of transactions. The regulation requires an explanation to buyers if the transaction involves the above (ii) and (iii) elements and requires approval from the government if the transaction involves the above (i), (ii), and (iii) elements. Please note that there has been no case the approval was obtained yet, and, thus, no one knows the difficulty of obtaining the approval.

We are often asked the way to give economic benefit to RWA token holders. Simply giving the economic in principle causes the issues of both or either of fund regulations and goods deposit transaction regulation and makes token issuance not feasible.

Ⅴ Prepaid Payment Instruments

There are RWA tokens that give a right to acquire products or use products such as hotel rooms, etc. Issuance of tokens linked to the right to acquire or use real assets is, in principle, subject to prepaid payment instrument regulation under the Payment Services Act. Some RWA tokens give those rights to holders and are subject to the regulation. For example, Not A Hotel NFT, which gives a holder to stay in a luxury residence, is subject to the regulation.

There are two types of prepaid payment instruments. The first type is the private-type prepaid payment instrument, which can be used only against the issuer or its closely related persons. The issuer of the private prepaid instrument shall file a notification to the Finance Bureau and deposit half amount of the unused amount, except for the case when the issuer only issues instruments that have less than 6 months’ expiration date or the unused balance at a certain reference date is 10 million yen or less.

The second type is the third-party type prepaid payment instrument, which can be used against other than the issuer or its closely related persons. The issuer of the third-party type prepaid payment instruments shall register with the Finance Bureau, except for the case when the issuer only issues instruments that have less than 6 months’ expiration date.

Ⅵ Secondhand Goods Business Regulation

A business that sells, purchases, or exchanges once-used goods such as used cars, used bags, used jewelry, and published artwork is, in principle, subject to the secondhand goods business regulation. A person who conducts the secondhand goods sales and purchase business shall file a notification to the police agency and shall conduct KYC of its customers. It is conceivable, however, that this regulation would not apply to the division and sale of the right of secondhand goods, and thus RWA tokens, which related to the divided right of real goods, are exempted from the regulation.

Ⅶ Other Regulation

In addition to the above, sales, etc., of assets might require consideration of asset-specific regulations. For example, to sell alcohol needs an alcohol sale license, and the seller of RWA tokens UniCask, which relates to a barrel of whiskey, takes the alcohol sale license.

Ⅷ Substantive Legal Issues

Compared to a simple sale of real world assets, RWA tokens require more careful consideration of what rights will be transferred and how to perfect the transfer. Holding RWA tokens does not necessarily mean having ownership of real assets, and transferring RWA tokens does not necessarily mean automatically transferring the ownership of the real assets.

For example, when you transfer real estate, you need to file a real estate transfer registration, and without it, you cannot insist that you are the owner of the real estate to third parties, and just transferring tokens on a blockchain may not suffice this requirement. To transfer tangible property in Japan might be possible just by transferring tokens, but careful consideration is necessary. The law regarding the transfer and perfection of real assets may vary in different jurisdictions, and generally, the laws in the country where the real asset is located apply.

Disclaimer

The content of this article has not been confirmed by the relevant authorities or organizations mentioned in the article but merely reflects a reasonable interpretation of their statements. The interpretation of the laws and regulations reflects our current understanding and may, therefore, change in the future. This article does not recommend investment in RWA tokens. This article provides merely a summary for discussion purposes. If you need legal advice on a specific topic, please feel free to contact us.

1 What is DAO?

A DAO is a decentralized autonomous organization that drives a business or project forward using smart contracts without a specific owner or manager. Overseas clients sometimes ask our firm whether they can sell DAO tokens in Japan.

2 Summary of regulation on sales of DAO tokens to Japanese residents

| (1) You need to consider Japanese regulations when you sell DAO tokens to Japanese residents, even if you reside outside Japan. (2) Regulations on DAO tokens differ depending on whether they are investment DAO tokens or community DAO tokens. (3) Investment DAO tokens are generally considered “security.” Their sale is usually regulated by the Financial Instrument and Exchange Act (FIEA). The seller must obtain FIEA registration or delegate the sale’s activities to a licensed FIEA company. Some exemptions exist, but they are not easy to use. (4) Sales of community DAO tokens are either (i) unregulated, (ii) regulated by the Crypto Asset Exchange Business Law, or (iii) regulated by the FIEA, depending on the nature of the tokens. |

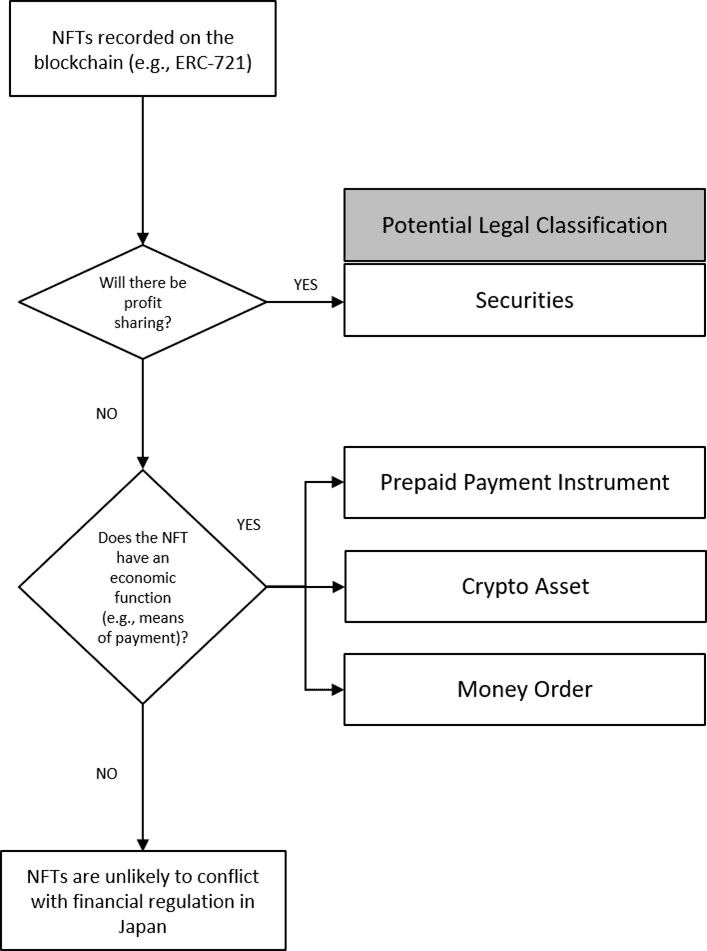

Below is a chart you need to consider before selling DAO tokens to Japanese residents.

<Chart to be considered>

3 Community DAOs and financial regulation

Community DAOs often issue governance tokens.

To consider the financial regulation of sales of DAO tokens in Japan, we must look at (a) whether the DAO provides some kind of dividend or more than 100% redemption of the principal (“Dividend, Etc.”), (b) whether the DAO has any legal entity nature that is similar to a joint stock company or LLC and whether the tokens represent nature similar to shareholders rights, and (c) whether DAO tokens can be used as a payment method.

3.1 DAO tokens that distribute Dividend, Etc.

Tokens in most community DAO do not have any dividend feature or profit distribution feature for token holders. If there are such features, the regulation on investment DAO tokens will be applied. Please see item 4 below.

3.2 DAO tokens issued by a company

If a DAO is structured in the form of a company, which happens rarely, and the DAO token awards member rights of the company to token holders, the right might be deemed as securities. Type 1 Financial Instruments Business Registration is required for the sale of those tokens.

3.3 DAO tokens issued by non-company

In general, many DAOs are formed without clarification of the legal form. Some DAOs just use a smart contract and do not have any form of legal entity. Under Japanese law, such DAOs may be classified as partnerships or “associations without a juridical person.” The rights of partnerships and associations without juridical persons do not fall under securities unless there are Dividend, Etc.

The sale of DAO tokens without Dividend, Etc. and so on issued by an organization other than a company should be classified as a crypto asset or NFT.

If the tokens fall under the definition of crypto asset, their sale shall be made by a licensed crypto asset exchange business operator.

However, if the DAO token is considered an NFT, there are no restrictions on its sale.

The distinction between a crypto asset (FT) and an NFT

In 2023, the Financial Services Agency (FSA) issued guidelines stating the distinction between a crypto asset (FT) and an NFT: (https://www.fsa.go.jp/news/r4/sonota/20221216-2/20221216-2.html).

The guideline states that if the asset does not have “means of payment” characteristics, it is not a crypto asset and that having “means of payment” characteristics can be determined by the following criteria: In general, if (a) DAO tokens cannot be used as a payment method, and (b-1) the price of the token is more than JPY 1,000 or (b-2) the issued number of tokens is less than 1M, the tokens are considered NFTs, and their sale is not regulated.

| FSA’s revised guidelines a) The issuer must make it clear that the tokens are not intended to be used to pay for goods or services to an unspecified person. For, example the terms and conditions provided by the issuer or business operator handling the product clearly prohibit the use of the product as a payment method, or the system is designed to prevent the use of the product as a payment method. b) Taking into consideration the price and quantity of the relevant property value, technical characteristics and specifications, and other factors as a whole, the tokens that can be used to reimburse an unspecified person for the price of the goods and so on must be limited. For example, the tokens must have one of the following characteristics: ・The price per minimum transaction unit must be high enough not to be used as an ordinary means of settlement (JPY 1,000 or more). ・The issued number of tokens divided by the minimum trading unit (issued volume considered after divisibility) must be limited (1 million or less). |

4 Investment DAOs and Financial Regulation

4.1 Investment DAO tokens are generally considered securities and regulated by FIEA

Under the FIEA, DAO tokens that pay Dividend, Etc. generally fall under the category of “electronically recorded transfer rights.” Thus, in order to sell electronically recorded transfer rights, you must either register as a Type 1 Financial Instruments Exchange Business Operator (Type 1 FIEBO) and conduct the sales yourself or have a Type 1 FIEBO do it for you. Furthermore, when soliciting 50 or more persons and issuing 100 million yen or more, the solicitation of the tokens becomes a public offering (Article 2, Paragraph 3 of the FIEA), which requires the submission of complex offering documents and continuous disclosure.

4.2 Exemption from FIEA might apply to some tokens, but it is not easy to use

As an exception, if sales are made only to qualified institutional investors (QIIs, professional investors) or wealthy individuals (with financial assets of JPY 100 million or more) who are 49 or younger, and if technical restrictions are in place to prevent other individuals from becoming DAO token holders through resale, then the sale falls under the exception category called “special business for qualified institutions, etc.,” and self-offering only requires a simple notification under Article 63 of FIEA.

We have heard that many investment DAOs in the US are issued to QIIs, and many investment DAOs limit their sales to avoid US security regulations. The problem in Japan is that the definition of “professional investors” is much narrower than in the US. In Japan, one criterion for becoming QII is that corporations and individuals must have at least JPY 1 billion in securities. In the US, a person who has more than USD200,000 annual income can become a QII, and in the EU, a person who has more than EUR500,000 in financial assets (in addition to satisfying other requirements) can be a QII. These requirements are much easier to satisfy than the requirements in Japan.

Japan also has a narrower exception to submit offering documents. In Japan, offering documents are required for offerings exceeding JPY 100 million. In contrast, exemptions apply for offerings less than USD6 million in the US (sales by Reg A Tier 1) and less than EUR5 million in some countries in the EU.

In light of the above, the issuance of investment DAOs is not popular in Japan but is still possible if you obey Japanese regulations.

EOD

I. What is a Blockchain Game?

A blockchain game is a game that uses the blockchain and uses crypto assets, tokens or NFTs (Non-Fungible Tokens).

In a typical game the following occurs:

(1) user purchases game assets that belongs to the game operator rather than the user,

(2) such game assets cannot be freely transferred, sold, or lent out, and

(3) even time-consuming data disappears after game distribution ends.

Whereas in blockchain games, it is said that the following occurs:

(1) the user is the holder of the token (game asset),

(2) the token can be transferred, sold, or lent out to third parties,

(3) third parties can also use the token, and

(4) as long as the blockchain exists,1the recorded digital assets will exist in perpetuity.

Ⅱ. Laws to Consider and Conclusions

When providing a blockchain game to Japanese residents, the laws listed below should be taken into account. Here is a summary of the laws that pertains to this matter:

| (1) Fund Settlement Law and Security Act |

| To issue and sell NFT itself is not regulated in Japan. Exception to it is (i) if tokens are deemed as crypto assets, such as fungible token which might be used as a payment method, they might be regulated under the Fund Settlement Law and (ii) if tokens are deemed as security, such as tokens including dividend feature, they might be regulated by the Financial Instrument Exchange Act. |

| (2) Act against Unjustifiable Premiums and Misleading Representations (hereinafter refer to Premiums Law or Premium and Representation Law) |

| Blockchain Game players might be given tokens, digital currencies, NFTs, digital assets or other gifts which have financial value when a user register, login, play a blockchain game. These gifts might be considered “premiums” or “free gifts” under the Premiums Regulations of the Premiums Law and the value of them are limited. |

| If the Play to Earn games allow players to (a) purchase NFTs and (b) earn some reward (e.g., NFTs or tokens) by playing the game, the reward portion may be subject to the prize regulation. There is an argument that depending on the game design, the reward may not be considered an extra (premium) and may not be subject to the Premiums Law. |

III. Legal Considerations

The following is a discussion of each legal issue.

1. Crypto Asset Law and Security Act

(a) Where is the problem?

Under blockchain games, the game operator frequently sells game characters, items, weapons, and land etc. as NFTs to users in exchange for ETH or other crypto assets.

Japanese law does not regulate sales of pure NFT, but regulate sales of crypto assets and sales of securities. Thus, whether sold tokens are not deemed as crypto assets or securities are crucial issue.

(b) What are crypto assets?

Under the Fund Settlement Act, the seller, Crypto Asset is defined as follows:

| Definition of Crypto Assets (Article 2 Section 5 of the Fund Settlement Act |

| Definition of Type 1 Crypto Asset |

| A property value that is recorded in electronic record and transferred electrically, that can be used to pay for the purchase of goods or receive services to an unspecified person, and that can be purchased and sold to an unspecified person (excluding some stable coins and securities). |

| Definition of Type II Crypto Assets |

| Crypto Asset that is recorded in electronic record and transferred electrically which can be mutually exchanged with the Type I Crypto Asset with an unspecified party (excluding some stable coins and securities). |

Selling or providing custody of crypto assets are highly regulated and must generally be handled by registered crypto asset exchange operator and also it is not feasible for a blockchain game operator to obtain registration.

At this moment, whether tokens are considered as crypto assets is determined by the number of issued tokens and whether the tokens can be used as some form of payment. NFTs are generally not considered as crypto assets, but if a game operator says it is an NFT, and the NFT has payment features etc., it may be considered a crypto asset.

(c) What are Securities?

Japanese Financial Instrument and Exchange Act (FIEA or Security Act) governs the issuance or sales of securities. Securities includes stocks, bonds, mutual funds, collective investment scheme etc. We have been often asked by blockchain game operators whether it is legal in Japan to sell NFTs, such as land, which generate “income” or “dividend”. If NFTs generate income without the participation of players, they may be classified as securities. Thus, when selling profit-generating tokens, the game should consider including features of players’ effort, such as editing land to attract customers.

2. Gambling offenses

(a) General Remarks

The crime of gambling under the Penal Code is established by (1) contesting the gain or loss of property profits by (2) winning or losing by chance. In addition, not only money but also “property interest” is considered to be the object of gambling, and rice, land, and debt collection are all considered to be “property interest” subject to the crime of gambling. Crypto assets are also considered to fall under the category of property interest.

| Article 185 (Gambling) |

| A person who engages in gambling shall be punished with a fine of not more than 500,000 yen or a fine. However, this shall not apply when the betting is limited to betting on objects provided for temporary entertainment. |

(b) Gacha (Loot Box), Reveal and Gambling Law

Some blockchain games have features of Gacha (loot box) and reveal. Users pay money or crypto assets to a gaming company and get NFTs randomly. For example, users pay 1ETH to get a game character NFT. Game characters may include Julius Caesar, Guanyu, Genghis Khan, Napoleon, George Washington etc, and those characters have different strength, powers, rarity etc, and what users can get is not revealed to users.

It was believed that these sales might be considered as gambling because (i) users pay property value, (ii) users receive property value which differs by chance, and (iii) there is winning or losing (of property value) by chance. However, in 2022, blockchain industries talked with a famous criminal law professor and some regulatory authorities and issued the guideline which states certain Gacha and reveal is not considered as gambling. Although the guidelines have no effect to police or criminal courts, the industry is now considering how following the guidelines may reduce the likelihood of criminal penalties.

The requirement is that the issuer and operator of games do not sell the same NFTs at different prices (for example, if the issuer sells NFTs that include Napoleon with 1ETH via Gacha, the issuer is not allowed to sell Napoleon NFT at a different price in another method), and do not buy back NFTs in a secondary market (for example, the issuer cannot buy back Napoleon NFT in 0.5ETH or 1.5ETH). In such cases, there is either winning or losing), and the issuer and operator shall not overstate the value of some NFTs in Gacha over other NFTs in Gacha.

(c) Synthesis

The same theory that applies to Gacha may apply to synthesis, but because synthesis is not discussed in the guidelines, we take a more cautious approach to synthesis.

3.Premiums and Premiums Law

(a)Initial Start

Developers often ask us of blockchain games if it is possible to give NFTs, game currency, crypto assets, other property to users free as a login bonuses, playing bonus and ranking bonuses etc. When conducting such distribution, it is necessary to consider the relationship with the Premiums and Representation Law.

(b) About the Premiums and Representation Law

The Premiums and Representation Law prohibits the offering of excessive premiums.

Premiums are (1) offered as a means of inducing customers, (2) offered incidental to a transaction, and (3) economic benefits such as goods or money. As the definition of economic benefits is broad, crypto assets, NFTs, in-game currencies, and other benefits might be considered as economic benefits.

Excessiveness will vary depending on whether the sweepstakes is general sweepstakes, joint sweepstakes, or all-inclusive sweepstakes, Still, it will be based on the following criteria to the extent that it is considered relevant to the game.

| Description | Example | Limits on Premium and Prizes | |

| Total Prizes | Offering prizes to anyone who uses the products or services or visits the store, not through sweepstakes. | Gifts for all purchases, gifts for all visitors, etc. | Transaction value less than 1,000 yen – Premiums up to 200 yen. Transaction value is over 1,000 yen – Premiums are capped at 2/10ths of the transaction value |

|

General Sweepstakes |

Offering prizes to users of goods or services by chance, such as lotteries, or by the superiority of specific actions. | In-store raffles, quiz and game competitions. | Transaction value less than 5,000 yen – 20 times the transaction value. Transaction value of more than 5,000 yen – 100,000 yen. (Both are capped at 2% of the total expected sales amount) |

(c) Ranking Rewards and the Premiums and Representation Law

In traditional smart phone games, the top-ranking players frequently receive in-game currency. The economic value of in-game currency has been treated as zero or very low by game operating companies, and there is no issue under the Premiums and Representation Law.

In blockchain games, crypto assets and NFTs, which can be sold outside of the game might be given as prizes. In this case, the general sweepstakes restrictions apply. The transaction value determines the amount of the prize. Although it is difficult to determine how much the transaction value is, a reasonable approach would be to set the minimum charge as the transaction value and allow rewards of up to 20 times the minimum amount or 100,000 yen, whichever is lower.

(d) Play to Earn and the Premiums and Representation Law

If we consider a Play to Earn game as a game where players (a) purchase NFTs or game currency and (b) earn some reward (e.g., NFTs or game currency) by playing, the reward portion may be subject to the Premiums Regulation.

However, whether earned NFTs or game currencies will be considered “premium” is unknown. There is an argument that the Premiums Law does not apply to Play to Earn games because the rewards are not “extras (premiums),” but rather the purpose of purchasing NFTs and playing the game itself. Lottery winnings and game-play prizes, for example, are not considered “premiums,” but rather “the purpose” of the transaction itself (gambling law shall be discussed lottery winnings and game-play prizes). This issue has not been resolved in Japan, and careful deliberation is required.

Reserved Matters

The contents of this document have not been verified by the relevant authorities and are merely a description of arguments considered reasonable under the law. It is only the current thinking of our firm, and our firm’s thinking is subject to change.

This document does not recommend using blockchain games or purchasing NFTs.

This document is intended for blogging purposes only. Please consult your lawyer if you need legal advice on a specific case.

Introduction

Clients often ask us whether it is possible to structure a Decentralized Autonomous Organization (DAO) in Japan. Currently, Japan does not have regulations targeting DAOs, unlike Wyoming State or the Marshall Islands. So, we have written this article summarizing what is typically considered when forming a DAO in Japan.

1.DAO

1.1 What is DAO?

A decentralized autonomous organization (DAO) is a new legal structure with no central authority and members committed to acting in the organization’s best interests. DAOs are used to make decisions in a bottoms-up management style and have gained popularity among cryptocurrency enthusiasts and blockchain technology.

1.2 Classification of DAOs

There are several classifications of DAO described below:

| 1. Investment DAO Investment DAOs are for-profit DAOs aim at co-investing in a project. They are more likely to attract funds than Grant DAOs because they aim to generate profits mainly through “economic capital.” Examples: Genesis DAO, The LAO, BitDAO, etc. 2. Grant DAO The community contributes monies to the grant pool and votes on funds allocation and distribution decisions in a Grant DAO. Innovative DeFi projects are funded using these DAOs, showing how decentralized communities are more flexible with funding than traditional organizations. Examples: MolochDAO, MetaCarteDAO, Aave Protocol, Uniswap Grants, etc. 3. Protocol DAO When tokens serve as a voting metric for implementing any changes in the protocol, such a governance structure represents protocol DAOs. For instance, MakerDAO has revolutionized the DeFi space with its DAI stablecoin. Examples: Maker, Compound, Uniswap, Aave, Yearn, Sushi, etc. 4. Service DAO A Service DAO is a decentralized working group. They can receive tokens as compensation for their projects. Examples: RAID GUILD, DXdao, PartyDAO, etc… 5. Social DAO A Social DAO offers digital democracy where opinions are heard, and people can share common interests. Example: Bored Apes (BAYC) 6. Collector DAO Artists who use nonfungible tokens (NFTs) to create art rely upon collector DAOs to establish ownership of their art. Example: PleasrDAO 7. Media DAO Media DAOs allow product owners of content (i.e., readers) to contribute directly without involving advertisers for the native token as a reward in return for their contributions. Example: Fore Front (FF), Bankless DAO, etc… Source https://cointelegraph.com/daos-for-beginners/types-of-daos |

1.3. Example of an Existing Overseas Law

A few places where DAOs are regulated are Wyoming State and the Marshall Islands. Below is a short description of forming a DAO in the Marshall Islands.

The Legal Form of a DAO on the Marshall IslandsMarshall Islands proposes a non-profit corporation (limited liability company) as a legal entity form for DAO, which stands out from the general practice to establish DAO as a foundation. Such a company is established in compliance with the general corporate law of the Marshall Islands with specific features that:

How does this work?Generally speaking, such a company works as a limited liability company managed by its members. It has three essential constitutional documents: Certificate of Incorporation, Operating Agreement, and Charter of the Company.The Operating Agreement should include the most crucial matters of your DAO management:

You can amend any of these matters by the members’ decision in compliance with the procedure prescribed in the previous version of the Operating Agreement. Registering a Marshall Islands LLC for DAOHere’s what the process of establishing a legal wrapper for DAO on the Marshall Islands looks like:

The above is a reference from Taras Zharan Web 3 Virtual Legal Officer. https://legalnodes.com/article/marshall-islands-llc-as-a-dao-legal-wrapper |

2. Financial Regulations on DAOs

2.1. Points to Consider

When structuring a DAO, one must consider the financial regulations and the legal form characteristics.

Here are several points to keep in mind:

1. Security regulation under the Financial Instrument and Exchange Act (“FIEA”) may apply when tokens have the possibility of dividends or redemption of the principal of more than 100% (dividends and redemption of the principal of more than 100% are from now on collectively referred to as “dividends, etc.”). As a general rule, token sales of such DAO must be conducted by a Type 1 Financial Instrument and Exchange Business Operator (“Type I license”) or by obtaining a Type 2 Financial Instrument Exchange Business Operator license (“Type II license”).

2. When selling Fungible Tokens without dividends, etc., it is necessary to have a Crypto Asset Exchange Operator conduct the sale or to obtain a Crypto Asset Exchange Operator license.

In contrast, these financial regulations generally do not apply when selling NFTs without dividends, etc.

3. You also need to consider the tax benefits. If you want to pursue tax advantages in an Investment DAO with dividends, etc., you can use a partnership or GK-TK scheme. If tax advantages are not particularly important, an association without rights, a general incorporated association, or a limited liability company can be considered a scheme to issue tokens. For the issuance of Fungible tokens or NFTs without dividends, etc., it may be better to have no particular legal structure.

2.2. Reference Table of Conclusions

The table below summarizes the legal scheme and financial regulations that should be considered in establishing a DAO.

The following regulations apply to token sales of Investment DAOs with dividends, etc. (assuming dividends or principal redemption of more than 100%).

| Type of Member’s Rights | Form under Japanese Law | Free distribution of Tokens | Token Sale | Investment Management |

| DAO member’s rights as shareholders’ rights in Limited Liability Companies and Joint-stock Companies | Tokenization of shareholders’ rights of limited liability companies, etc. | Free distribution of the shareholders’ rights is not allowed under corporate law, etc. |

Sales by a third party for an issuer need a Type I license. A Type II license is necessary for the self-offering of a limited liability company. No license is required in the case of self-offering of a joint-stock company. In the case of solicitation of 50 or more people, there needs to be a submission of a registration statement regarding securities, etc. |

No regulation |

| DAO member’s rights (with dividends), not including shareholders’ rights | TK investment, partnership investment, tokenization of rights that are difficult to classify into prescribed legal forms, etc. | Unregulated |

Sales by a third party for an issuer need a Type I license. Self-offering needs a Type II license. In the case of solicitation of 50 or more people, there needs to be a submission of a registration statement regarding securities, etc. |

No regulation (Possibility of Investment Management Business license in the case of securities investment) |

On the other hand, a DAO without dividends, etc., is also possible. Its regulations are as follows:

| Tokens/NFT | Free Token Distribution | Sale of Tokens | Investment Management(Assuming no dividend) |

| Utility Tokens | No regulation | Crypto Asset Exchange Business regulation | No regulation |

| NFT | No regulation | No regulation | No regulation |

With respect to possible legal forms for DAOs, the following comparisons can be made:

| Status | Legal Form | Limited Liability | Is it possible to distribute? | Avoid Double Taxation | Others, Comprehensive Evaluation |

| No Legal Entity Status | Association without rights +Tokens with unclear rights | 〇? | 〇 | × |

△~〇 High degree of freedom. A good scheme if there is no problem with double taxation. |

| Civil Law Partnership + Partnership Equity Token | × | 〇 | 〇 |

△~〇 High degree of freedom. A good scheme if there is no problem with limited liability. |

|

| Investment Business Limited Liability Partnership + partnership Equity Token | 〇 | 〇 | 〇 |

× Although other points are reasonable, there are restrictions on investment destinations and businesses, such as not being able to purchase NFTs. It’s usually hard to use this scheme as DAO. |

|

| Limited Liability Partnership + Partnership Equity Token | 〇 | 〇 | 〇 |

× There are valid points; however, to use as a DAO is problematic because of the need to register the name of the union member. |

|

| DAO has Legal Entity Status |

Corporation (*1) + Tokenization of Anonymous Partnership (e.g., TK-GK scheme) |

〇 | 〇 | 〇 | △ It is necessary to operate in accordance with the Companies Act and the General Incorporated Associations Act. It should be noted that TK holders do not have the right to instruction. The good point is that there is no double taxation and limited liability. |

|

Corporation (*1) + Token with unknown rights |

〇? | 〇 | × | △ ~ 〇 It is necessary to operate under the Companies Act and the General Incorporated Associations Act. Besides that, it has a high degree of freedom and is a good scheme if you don’t mind the double taxation problem. | |

|

Corporations (*1) + Tokenization of shareholders rights (*2) |

〇 | 〇(× For general incorporated associations) | × |

× Is there a low degree of freedom due to the need to operate per the Companies Act and the General Incorporated Associations Act? For example, it is necessary to manage members as shareholders. |

*1 Legal entities include limited liability companies, stock companies, and general incorporated associations. LLCs are generally easier to establish and operate than joint-stock companies. If you want to have a more public image, use a general incorporated association.

*2 Membership rights of a limited liability company, stocks of a stock company, membership rights of a general incorporated association.

2.3 Tokenization of Rights

Tokenization of rights of funds or partnership, where there is an investment of funds (including money and crypto assets), investment management, dividends, or redemption of the principal of more than 100%, would be broadly considered a collective investment scheme (fund) under Japanese law. Below is the summary of the Definition of a Collective Investment Scheme.

| Summary of Definition of Collective Investment Scheme |

| Rights that satisfy the following (i) to (iv) |

| (i) Rights under a partnership agreement as defined in Article 667(1) of the Civil Code, a silent partnership agreement as defined in Article 535 of the Commercial Code, an investment limited partnership agreement as defined in Article 3(1) of the Act on Limited Liability Partnership Agreement for Investment Business, or a limited liability partnership agreement as defined in Article 3(1) of the Act on Limited Liability Partnership Agreement for Investment |

| (ii) The existence of a business (the “Invested Business”) in which money (including cryptographic assets) contributed or contributed by the person who has such rights (the “Investor”) is allocated to the Invested Business; |

| (iii) The investors are entitled to receive dividends of profit generated from the invested business or distribution of assets related to the invested business; |

| (iv) There are no exceptional circumstances, such as all investors being constantly involved in the business. |

The revised Financial Instruments and Exchange Act, which came into effect on May 1, 2020, created the legal concept of Electronic Record Transfer Rights. The rights of tokenized collective investment schemes usually fall under the Electronic Record Transfer Rights below.

| Outline of Definition of Electronically Recorded Transfer Rights |

| Rights that satisfy the following (i) to (iii) but exclude (iv) (Article 2, Paragraph 3 of the FIEA): |

| (i) Rights listed in each item of Article 2, Paragraph 2 of the FIEA (funds, trust beneficiary rights, members’ rights of general partnerships, limited partnerships, limited liability partnerships, etc.); |

| (ii) When they are expressed in property values that can be transferred through an electronic data processing system; |

| (iii) When recorded in electronic devices or other objects by electronic means; |

| (iv) Cases provided in the Cabinet Office Ordinance have considered the nature of distribution and other circumstances. |

The sale of this electronic record transfer right requires a Type 1 Financial Business registration. If soliciting more than 50 people, it will be a public offering (Article 2, Paragraph 3 of the Financial Instruments and Exchange Act), and a securities registration statement must be submitted based on Article 5 of the FIEA.

If the sale is limited to qualified institutional investors or wealthy people of 49 or less, and even if there is resale, there are technical restrictions so that other people cannot become DAO token holders.

When the Investment DAO is formed, it can be sold in such a limited form at first, and after it grows, it can be sold to the general public while complying with increased regulations.

2.4 Tokenization of Company Membership Rights and Financial Registration Regulations

Regarding tokenization of company membership rights, a Type I FIBO license is necessary when a third party sells the rights, and Type II is essential in the case of self-solicitation. In the case of tokenization of company membership rights (shareholders rights) of a joint stock company, a Type I license is necessary in the case of solicitation by a third party, and no license is required in the case of self-solicitation.

2.5 Regulations on Public Offerings, etc.

If any of the following applies, it becomes a public offering. In principle, it is necessary to submit a securities registration statement.

| (i) When soliciting the acquisition of securities from 50 or more persons (excluding Qualified Institutional Investors (QII) in the case there are restrictions on resale other than QII); (ii) When it does not fall under any of the following categories: Private Placement for QII, Private Placement for Professional Investors, and Private Placement for Small Groups. |

2.6 Financial Regulations for DAOs without Dividends

If DAOs have no dividends, etc., they are not considered securities, but different financial regulations may apply.

| Tokens/NFTs | Free token distribution | Token Sales | Investment Management (Assumption without dividends) |

| Utility Tokens | Unregulated | Crypto Asset Exchange Business License | Unregulated |

| NFTs | Unregulated | Unregulated | Unregulated |

Disclaimer

The content of this article has not been confirmed by the relevant authorities or organizations mentioned in the article but merely reflects a reasonable interpretation of their statements. The interpretation of the laws and regulations reflects our current understanding and may therefore change in the future. This article does not recommend investment in DAO. This article provides merely a summary for discussion purposes. If you need legal advice on a specific topic, please feel free to contact us.

Ⅰ. Introduction

We posted (1) an article titled “Crypto Fund“( in Japanese) on 1 June, 2018, and (2) an article titled “Funds Regulations in Japan” on 30 June, 2020.

In 2021 and 2022, we received many inquiries regarding setting up crypto funds. Considering (i) the amendments in 2020 to the Payment Services Act(PSA), (ii) the rise of NFT, DeFi, and stablecoins, and (iii) changes to the taxation of crypto assets, we therefore are updating (1) the article titled “Crypto Fund.”

In general, the term “crypto fund” can be used in a variety of ways, such as where (i) the fund’s financial source is crypto assets which include Bitcoin and Ether, (ii) the fund’s investment targets are crypto assets or crypto related businesses for instance BTC, ETH, SAFT, ICO tokens, NFT, stablecoins, security tokens, DeFi, and stocks of crypto related companies, and (iii) the investor’s rights are tokenized.

Therefore, the following is an overview of the regulations that apply to each type of structure.

Since this article focuses on crypto funds, other kinds of funds (investment in fiat currency and securities management) are not mention in this article, except in section VIII.1. For regulations on other kinds of funds, please refer to (2) the above article titled “Funds Regulations in Japan. “

Ⅱ. Regulations on Fund Raising

1. Regulations on Fund Raising in Fiat Currency

Under the Financial Instruments and Exchange Act (FIEA), soliciting investments in money (fiat currency), using it to conduct business, and distributing the proceeds from the business falls under a collective investment scheme (Article 2(2)(v) of the FIEA).

Soliciting investments in a collective investment scheme (public offering or private placement, Article 2(8)(vii)(f)) falls under the Type II Financial Instruments Business (Type II FIB) (Article 28(2)(i) of the FIEA) in principle, and public offering or private placement is not allowed without registration as a Type II Financial Instruments Business Operator (FIBO) (Article 29 of the FIEA). This is also the case for crypto funds where the means of fundraising is money, and the investment targets are crypto assets.

There are some exceptions to this fund regulation under the FIEA, such as (i) cases where the fund completely outsources the solicitation to another Type II FIBO and does not solicit any acquisitions on its own, (ii) cases where the fund uses the exemption so called Specially Permitted Businesses for Qualified Institutional Investor (QII) (Article 63 of the FIEA) (Article 63 Exemption or QII etc. Exemption), and (iii) cases where the fund is more than 50% funded by overseas investors and the domestic investors are limited to certain investors such as QII (Overseas Investor’s Exemption)( Article 63-8 of the FIEA).

Whether or not the issuer does not conduct any solicitation for acquisition is determined by the circumstances in each case. Solicitation for acquisition refers to the solicitation of an application to acquire newly issued securities and similar activities (Article 2, Paragraph 3 of the FIEA). Solicitation is generally understood to be an act that attracts and encourages investors to acquire a particular security, whether in writing, verbally or through advertising.

Specially Permitted Businesses for QII is an exemption that allows a fund manager to engage in fund services by making a simple notification to the Financial Services Agency (FSA) when all investors in the fund are QII or when the investors include one or more QII and 49 or fewer persons who are expected to have certain investment abilities. However, that exemption has been subject to tighter regulations under the 2015 amendment to the FIEA. Before the amendments, the scope of 49 or fewer investors included general individual investors. It should be noted that after the amendment, individual investors whose total amount of investable financial assets (referring to securities, etc., but not including crypto assets) is 100 million yen or more and who have been in a security account for one year would be able to invest.

2. Regulations on Fund Raising in Crypto Assets

Until the amendment of the FIEA in 2020, soliciting investments in funds with crypto assets was not subject to the FIEA regulation. However, due to the amendment, crypto assets are now considered as money equivalent in relation to fundraising (Article 2-2 of the FIEA). Fund raising with crypto assets is now subject to the same regulations as fund raising with money.

(Summary of Regulations on Fund Raising )

| General Registration Requirements | Exceptions | |||

| When Completely Outsourced to a Third Party |

Article 63 Exemption (QII etc. Exemption) |

Overseas Investor’s Exemption | ||

| Sales by Issuer | Type II FIBO Registration |

N/A registration) |

Available | Available |

| Sales by Third Party (on behalf of the issuers) | Type II FIBO Registration |

N/A (rarely the case) |

N/A Type II FIBO Registration |

N/A |

Ⅲ. Regulations on Investment Management of Funds

1. Regulations When Investments are Primarily in Securities or Derivatives

With respect to funds the term investment management business is understood as the management of money or other property invested by a person connected with investments primarily in securities or derivatives which are based on investment decisions requiring the valuation and analysis of such instruments. In this context, “primarily” means that generally more than 50% of the assets under management are invested in securities or derivatives. To conduct an investment management business, a company must register as an Investment Management Business Operator (Article 28(4) of the FIEA). Similar to Type II FIBO, persons engaging in the investment management business must meet certain criteria, including minimum capital requirements and hiring proper personnel (e.g. a compliance officer with eligible knowledge and experience) for operating the business.

The securities include stocks as well as general security tokens. In order to avoid this regulation, it is necessary to set a limit on the investment objectives to the effect that no more than 50% of the investment should be in securities or derivatives. Similar to the above II.1, there are some exemptions. For example, registration as an investment management business is not required if (i) the fund meets requirements such as full outsourcing of management to other investment management companies, (ii) the fund is conducted as Article 63 Exemptions, or (iii) the fund is set up in a foreign country and investment from Japan is limited.

2. Regulations When Investments are Primarily in Crypto Assets

If the investment target is mainly crypto assets, the FIEA does not apply to the management. Since the management of crypto assets is for investment purposes and not for business purposes, the PSA does also not apply. When investing in NFT, SAFT, DeFi, stablecoins, the FIEA and the PSA do not apply to the management, as it does when investing in crypto assets.

(Summary of Regulations on Investment Management)

| General Registration Requirements | Exceptions | |||

| When Completely Outsourced to a Third Party | Article 63 Exemption (QII etc. Exemption) | Foreign Funds that Meet Certain Requirements | ||

|

Management of Funds that Invest +50% in Securities by GP |

Registration of GP as Investment Management Business Operator | N/A (For the third party, Investment Management Business Operator Registration) |

Available | No registration required |

|

Management of Funds that Invest +50% in Securities by Third Party |

Third party must register as Investment Management Business Operator | N/A If management activities are sub-delegated to a registered third party (rarely the case) |

N/A Third party must register as Investment Management Business Operator Registration |

N/A Third party must register as an Investment Management Business Operator registration |

|

Management of Other Funds (incl. crypto assets) |

N/A | N/A | N/A | N/A |

Ⅳ. Regulations on the Content of Investors’ Rights

1. Regulations on the Distribution of Money and Crypto Assets

A fund is generally set up by using a silent partnership agreement, a limited partnership agreement, or an overseas partnership agreement (collectively, partnership agreement), and investors have rights under such partnership agreement. In a crypto fund, it is assumed that there are cases where (1) the fund’s investment is solicited in crypto assets and then dividends or principal redemption in money, (2) the fund’s investment is solicited in money and then dividends or principal redemption in crypto assets, and (3) the fund’s investment is solicited in crypto assets and then dividends or principal redemption in crypto assets.

Since the transfer of the crypto assets is not a sale or exchange thereof, we believe that the PSA does not apply except in cases of legal evasions, such as formally soliciting investment in a fund with money and immediately redeeming the principal with crypto assets.

2. Regulations on the Tokenized Interest

With the 2020 revision of the FIEA the concept of Electronically Recorded Transfer Rights (ERTR)

were introduced. Article 2(3) of the FIEA defines ERTR as follows:

| “Electronic Recorded Transfer Right” are rights that fulfill all requirements from (1) to (3) and do not fall under (4): (1) Rights listed in Article 2(2) of the FIEA (funds, beneficial interest in a trust, membership rights of general partnership company, etc.) (2) which are recorded electronically, and (3) may be transferred by using an electronic data processing system. (4) Cases specified by Cabinet Office Ordinance taking into account the liquidity constraints and other circumstances. |

Some crypto funds may also consider tokenizing their rights. Interests in a fund which are tokenized are generally considered ERTR. Given their (potentially) increased liquidity they are subject to the same regulations as more liquid Type I Securities. Third parties engaging in the sale of tokenized interests must therefore register as Type I FIBO (Article 28 (1) (i), Article 2 (8) (ix) of the FIEA).

The self-solicitation of tokenized interests by a fund is subject to the same registration requirements as the self-solicitation of funds in general. A fund must therefore register as a Type II FIBO and, if ≥50% of the money is invested in securities or derivatives, as an Investment Management Business Operator, unless an exemption applies. The QII exemption 2 and the exemption in case of entrustment of all sales and investment activities to third parties also apply to tokenized funds.

For more detailed information on security token offerings (STOs), please click here.

(Business Regulations and Notifications Requirements under the FIEA for the Sale and Management of Tokenized Funds)

|

General Registration Requirements |

Exceptions |

|||

|

When Completely Outsourced to a Third Party |

Article 63 Exemption (QII etc. Exemption) |

Foreign Funds that Meet Certain Requirements |

||

| Sales | ||||

| Sales by Issuer | Type II FIBO registration |

N/A |

Available | Available |

| Type I FIBO registration |

N/A |

N/A Type I FIBO registration |

N/A |

|

| Investment Management | ||||

|

Management of Funds that Invest +50% in Securities by GP |

Registration of GP as Investment Management Business Operator |

N/A |

Available |

No registration required |

|

Management of Funds that Invest +50% in Securities by Third Party |

Third party must Register as Investment Management Business Operator |

N/A |

N/A |

N/A |

| Management of Other Funds (incl. crypto assets) | N/A |

N/A |

N/A | N/A |

Ⅴ. Disclosure Regulations

Since ERTR are generally subject to the same regulations as Type I Securities, disclosure requirements apply if investors’ rights are tokenized. An issuer of ERTR is therefore obliged to prepare a prospectus (Article 13 (1) of the FIEA) and to register the offering with the FSA (Article 4 (1)). In addition to the initial disclosure, ongoing disclosure requirements apply (Article 24). Something different only applies in the case of private placements. These are placements with QII, professional investors or a small number of investors (≤ 50 investors) only.

If investors’ rights are not tokenized, disclosure requirements apply to public offerings of type II securities, which fall under the category of Rights in Securities Investment Business, etc. (Article 3 (iii) (a)) that mainly invest in securities. In the case of Type II Securities, if the number of holders is less than 500 in response to a solicitation for acquisition, it does not fall under public offerings (Article 2 (3) (iii) and Article 1-7-2 of the FIEA Enforcement Order), and disclosure requirements do not apply.

(Disclosure Regulations)

| Type of Securities |

Type of Solicitation | Investors | Obligation to Disclose | |

| Type I Securities |

Private |

Private placement with QII only* |

QII only | Notification of specific matters (Article 23-13 (4) of the FIEA, Article 20 (1) of the Cabinet Order on Disclosure of Regulated Securities) |

|

Private placement to a small number of investors* |

≤49 investors | |||

|

Private placement to specified investors* |

Specified investors only |

N/A | ||

| Public offerings | Unlimited number of investors |

Securities registration statement ** (continuing disclosure of semiannual reports, extraordinary reports, etc.) |

||

| Type II Securities |

Private placement |

≤499 investors | N/A | |

|

Public offerings |

Unlimited number of investors |

Generally not applicable Rights in Securities Investment |

||

* Technical measures must have been taken to restrict resale.

** When the total issue price is less than JPY 100 million the obligation to file a securities registration statement does not apply (Article 4(1)(v) of the FIEA).

Ⅵ. Fund Scheme

1. Fund Scheme if Investing in Crypto Assets

Funds are generally structured using various types of partnership agreements. In Japan, investment Limited Liability Partnership (LLP) agreements are often used to set up PE funds and VC funds, etc. However, LLP is legally only allowed to engage in certain businesses (Article 3 (1) of the Act on LLP), and it does not include the acquisition and holding of crypto assets or stablecoins. Therefore, if the investment target is crypto assets or stablecoins, LLP cannot be used, and silent partnership agreements should be considered3.

2. Fund Scheme if Investors Rights are Tokenized

Suppose a fund tokenizes rights under a partnership-type agreement and transfers the token to investors. In that case, it seems necessary to consider whether simply tokenizing existing rights on the agreement will work properly.

For example, the following issues should be considered:

- Whether rights under partnership agreements are validly transferred only by transferring the tokens4

- If the governing law is not specified as in the case of The Dao, what will be the tax and accounting treatment in Japan

Ⅶ. Supplement

1. Investment in Crypto-Related or Blockchain-Related Companies

Funds that are financed in cash and invest primarily in shares of crypto-related or blockchain-related companies are sometimes called crypto-related funds.

As a fund that invests primarily in securities, such as this fund is, in principle, required to be registered as a Type II FIBO for its public offering or private placement and as an investment management business operator for its management (refer to II1. and III1.).

2. Management of Own Funds

When a company launches an “in-house fund” to invest its own funds in shares of crypto-related or blockchain-related companies, it may also be called crypto-related funds.

However, this does not fall under “investment of money or other properties invested or contributed from a person who holds the following rights or other rights specified by the Cabinet Order” (Article 2 (8) (xv) of the FIEA), so fund regulations under the FIEA do not apply.

3. Tax Issues of Crypto Funds

We are not experts in tax issues, but we describe here for your reference since tax issues are often a significant issue when setting up a crypto fund.5

If a company owns actively traded crypto assets in Japan, it is taxed at market value at the end of the term (so-called unrealized gains tax).

When a crypto fund is set up with TK-GK scheme, the silent partnership investors are not considered to own the assets, but GK is deemed to own, and therefore, in principle, unrealized gains are taxed in GK. However, if such unrealized gains are distributed to investors based on the silent partnership agreement, GK will not be taxed on that portion (effectively pass-through), while the portion equivalent to such gains will be treated as income of the investors (both individual and corporate investors).

When a crypto fund is set up with an overseas partnership, it is taxed as if investors themselves own assets of the fund (pass-through). Therefore, corporate investors of the overseas partnership are subject to unrealized gains tax.

Unrealized gains tax might be avoided by using a scheme in which a company is set up in a foreign country that does not tax unrealized gains and Japanese investors invest in the company as a silent partnership, and then unrealized gains are not allocated to the investors. However, it is necessary to consider Anti-Tax Haven Rules when using this scheme. If the overseas company’s shareholders are domestic companies or domestic individuals, the overseas company may be deemed to be a paper company or not meet the economic activity standards, and income of the overseas company might be deemed as income of the shareholders.

Therefore, you should consider the following factors and consult with legal and tax professionals to structure a crypto fund.

- Attributes of primary investors (Japanese company, Japanese resident, foreign company, or foreign resident)

- Whether tokens to invest in are subject to unrealized gains taxes (if the tokens are listed on a crypto exchange or DEX, whether you can sell them before the end of the fiscal year).

- Whether shareholders or GPs of overseas entities can move to Singapore or other countries.

| Scheme | Unrealized Gains Taxation on SPV |

Unrealized Gains Taxation on Corporate LP |

Unrealized Gains Taxation on Individual LP |

Taxation on Shareholders of SPV |

| TK-GK |

Taxed on GK |

Taxed if it is distributed | Taxed if it is distributed | N/A (in principle) |

|

Overseas |

N/A |

Taxed | N/A | N/A (depending on country) |

| TK-Overseas Company |

N/A (depending on country) |

N/A (in principle) |

N/A (in principle) |

Anti-Tax Haven Rules may apply |

Disclaimer

The content of this article has not been confirmed by the relevant authorities or organizations mentioned in the article but merely reflects a reasonable interpretation of their statements. The interpretation of the laws and regulations reflects our current understanding and may therefore change in the future. This article does not recommend the investment in crypto funds. This article provides merely a summary for discussion purposes. If you need legal advice on a specific topic, please feel free to contact us.

In this post, we analyze non-fungible tokens (NFTs), play-to-earn scholarships, and the Yield Guild DAO under Japanese laws. With respect to the scholarships, it is worth noting that they are mainly offered overseas – presumably in compliance with the relevant laws – and that Japanese laws only apply if Japanese residents are involved. The following post is written under the assumption that this is the case.

| You can find more information about the legal and regulatory environment for NFTs in our previous posts: |

1. Overview

1.1. Play-to-Earn (P2E)

The P2E model was pioneered by Axie Infinity. Axie Infinity is an online game that allows players to receive rewards in the form of Smooth Love Potions (SLP) when playing the game. SLP are tokens that are needed for breeding new Axies and which can be traded on global crypto exchanges.

1.2. Scholarships

To play Axie Infinity, a player needs at least three Axies. In August 2021, the price for three Axies was around USD 1,000 and as such unaffordable for many players. Yet, despite the high costs, the game continued to gain popularity – especially in countries with low incomes. One of the reasons behind the continued success were scholarships. Under the scholarship program, owners of Axies give their Axies to players who in turn use them for playing the game. When earning SLP as rewards, players must share them with the owners of the NFTs. The percentage players retain is somewhere between 40 and 75 percent, depending on the provider of the scholarship and scholarship program.

Scholarship programs in a nutshell

|

1.3. Yield Guild Games

Yield Guild Games (YGG) describes itself as a “play-to-earn gaming guild, bringing players together to earn via blockchain-based economies”. YGG initially raised funds from a16z and other investors in exchange for YGG tokens and invests those funds into NFTs that are used in blockchain games. Proceeds from utilizing the NFTs – for example from lending the NFTs to players of P2E games or selling them on the market – are distributed to YGG token holders.

In some cases, YGG further brokers scholarships for NFT holders who want to put their NFTs to use and earn a passive income. Initial activities focus on Axie Infinity, The Sandbox, and League of Kingdoms. Further games will be added in the future.

While the core team of YGG currently manages all activities, YGG aims to become fully decentralized in the future. Once the transition is completed, decision-making will be transferred from the core team to the YGG DAO, i.e. the YGG token holders.

2. Analysis under the Applicable Laws and Regulations

2.1. Legal Structures of Scholarships

Scholars and managers enter into scholarship agreements on an individual basis. Usually, the agreements are initiated via Discord or other channels. Under Japanese laws, the following structures may be considered.

2.1.1. Lease Agreement

Where a scholar promises to pay a certain amount of money for the use of Axies and to return the Axies at the end of the agreement to the manager, the agreement might be considered some form of lease. Since Article 601 Civil Code only covers the lease of tangible assets, it cannot be applied directly to the lease of intangible assets such as Axies. Applying Article 601 ff Civil Code by way of analogy seems, however, possible.

Assuming Articles 601 ff Civil Code can be applied analogously, scholars would not be allowed to sublease Axies to third parties without the prior consent of the managers (Article 612(1) Civil Code). In cases where the contract period is not specified by the scholarship agreement, the agreement may be terminated by either party by giving the other party one day’s notice (Article 617(1)(iii) Civil Code). As it is not clear whether courts will allow for an analogous application of Articles 601 ff Civil Code, it is advisable to cover all matters comprehensively in the scholarship agreement.

Since the use of Axies is not subject to restrictions under the Copyright Act, it is further advisable to implement proper measures to ensure that owners are sufficiently protected (e.g. prohibition to use Axies for breeding, prohibition to create merchandise with the Axie).

2.1.2. Contract for Work or Delegation

Managers may among others specify how many hours a scholar must play per month, require daily logins, or instruct scholars to only use Axies with certain characteristics for breeding. In addition, the scholarship agreement may stipulate a minimum amount of SLP a scholar must earn during a pre-defined period. In exchange, the manager agrees to pay a remuneration to the scholar.

Depending on the exact arrangement, the scholarship agreement may either be considered a contract for work (Article 632 Civil Code) or delegation without legal authority (Article 656 Civil Code). In both cases, scholars would have to deliver earned SLP to the NFT’s owner (Articles 632 and 646 Civil Code. Where the scholarship agreement is structured as a contract for work, NFT owners may further require scholars to complete the agreed work (Articles 559 and 562 Civil Code).

It is our understanding that the rewards collected by scholars are generally passed to the manager. Based on the scholarship agreement, the manager will then return a predefined amount to the scholar for playing the game. The situation is, therefore, similar to revenues generated by tenants of farmland.

2.1.3. Fund

The scholarship arrangement may further be structured as a partnership according to Article 667 Civil Code or a silent partnership according to Article 535 Commercial Code. In these cases, both the owners of the NFT and the scholar make contributions in kind – the owner by providing his Axies and the scholar by contributing his labor. Profits generated by the partnership or silent partnership are then distributed between NFT owners and scholars according to the scholarship agreement.

In a partnership, the owner may for example invest Axies and appoint the scholar as an executive of the partnership (Article 670(2) Civil Code). Here, the NFT owner would have the right to inspect the scholar’s business but lose the right to manage the partnership on his own (Article 673 Civil Code). If the scholar does not play the game and defaults, the agreement cannot be canceled (Article 667-2(2) Civil Code). Instead, the manager may request the dissolution of the partnership (Article 683 Civil Code). A voluntary resignation from the managing position by the scholar appointed as the manager of the partnership would only be possible if the scholar has a valid reason for resignation (Article 672(1) Civil Code).

| NFT Owners’ Rights and Obligations | Scholars’ Rights and Obligations | Other | |

| Lease |

|

| If the term is stipulated in the scholarship agreement, the agreement is automatically terminated with its expiration. Otherwise, it can be terminated by either party by giving one day’s notice. |

| Delegation / Contract for Work |

|

| The agreement may automatically terminate upon expiration of the term (if specified) or can be canceled by the manager at any time. If the manager decides to cancel the agreement which constitutes a contract for work, he must generally compensate the scholar for losses. If the agreement constitutes a delegation agreement, it may be terminated at any time by either party. |

| Fund |

|

| If the partnership has achieved the purpose for which it was set up, it is automatically dissolved. It is also dissolved if there are other reasons for dissolution which are stipulated in the scholarship agreement. Proceeds are distributed in proportion to each partners’ contribution in case of liquidation. |

2.2. Regulatory Considerations for the Different Scholarship Structures

The regulatory considerations vary greatly depending on the legal structure of the scholarships. For scholarships structured as leasing arrangements, money lending regulations may be considered. For agreements structured as partnerships or silent partnerships, the Financial Instruments and Exchange Act (FIEA) may be applicable. For scholarship structured as delegation agreements or contracts for work, no particular regulations apply.

2.2.1. Money Lending Business Act

Article 2(1) Money Lending Business Act defines money lending business as the business of lending money (including the provision of funds by discounted bills, the sale of mortgages, or similar methods) or acting as an intermediary for the lending of money. Businesses engaging in money lending services must register with the Financial Services Agency (FSA) (Article 3(1) Money Lending Act).

Since Axies neither constitute money nor a currency-denominated asset, the lending of Axies does not fall under the Money Lending Business Act. It is therefore not necessary to register with the FSA.

2.2.2. FIEA

The FIEA applies to a wide range of financial instruments and provides a comprehensive registration regime for businesses engaging in financial instruments services (Article 2(8) FIEA). According to Article 29 FIEA, businesses providing financial instruments services must generally register as a financial instruments business operator (FIBO) with the FSA. This also applies to those soliciting the offer to sell rights in a partnership or silent partnership. Both are generally considered collective investment schemes under the FIEA (Article 2(2)(v) FIEA).

Axies do, however, not fall under the category of money or money equivalent as specified in Article 2(2)(v) FIEA, Article 1-3 FIEA Enforcement Order, and Article 5 FIEA Definitions Ordinance. Even where the owner of NFTs contributes his NFTs to the partnership or the silent partnership, the FIEA does therefore not apply.

2.3. Regulatory Considerations concerning YGG’s Activities

2.3.1. Scholarship Brokerage

Since NFTs do not constitute money or currency-denominated assets (see item 2.2.1 above), the brokerage of scholarships does not constitute an intermediary service for money lending and is therefore not regulated.

2.3.2. YGG Tokens

On August 19, 2021, YGG announced that it had raised USD 4.6 million from a16z and other major venture capital firms. In exchange for their investment a16z and the other investors received YGG tokens. The tokens allow them to participate in the revenues generated by the YGG. Assuming the tokens were sold to investors in Japan, it is highly likely that they would qualify as rights in a collective investment scheme under Article 2(2)(v) FIEA – and given the tokenization of those rights – as electronically recorded transfer rights (Article 2(3) FIEA). In order to offer electronically recorded transfer rights to the public, it is generally necessary to file a prospectus and to register as a type II FIBO (Articles 28(2)(i), 2(8)(vii), 29 FIEA). Where the rights are only offered to qualified institutional investors a notification under Article 63 FIEA is sufficient.

If the solicitation is, however, performed by a DAO with a sufficient degree of decentralization, the solicitation falls outside the scope of the FIEA as there is no eligible intermediary that could be regulated. As YGG is still managed by the core team, this degree of decentralization has most likely not been achieved yet.

Finally, it should be noted that collective investing schemes investing in NFTs are not subject to disclosure obligations under Article 4 FIEA, as NFTs do not constitute securities.

2.3.3. Investment in NFTs

A fund investing exclusively in NFTs does not invest “in securities or in rights connected with derivatives transactions, based on investment decisions that are grounded in an analysis of values of financial instruments” as stipulated in Article 2(8)(xii) FIEA. It is therefore unlikely that the investment management regulations apply to the investment manager (Article 28(4)(i) FIEA).

As NFTs are further not considered crypto assets within the meaning of Article 2(7) Payment Services Act, the buying and selling of NFTs for investment purposes does not constitute a crypto asset exchange business. It is therefore not necessary to register as a crypto asset exchange service provider.

Disclaimer

This post is for discussion only. The content of this post has not been confirmed by the relevant authorities or organizations mentioned in the post but merely reflects a reasonable interpretation of their statements. The interpretation of the laws and regulations reflects our current understanding and may therefore change in the future.

This post does not recommend the use of or investment in NFTs, scholarships, or any other tokens or projects.

Axie Infinity and Yield Guild Games are only used for illustrative purposes. Given the format of the post, not all details of the game mechanics and token design have been considered comprehensively, so that the results of the assessment may deviate from the results by the regulator, or a legal opinion prepared by us or another law firm. By no means, the explanations should be understood as a legal opinion. If you need legal advice on a similar project, please free to contact us or consult with your lawyer.

Axie Infinity, the blockchain game by Sky Mavis, made major headlines recently. With more than 350,000 daily active players, the game is one of the most successful blockchain games so far. According to data from token terminal_, the game generated USD 581.7 million in revenue over the past 90 days. To put this into perspective, this is more than Ethereum over the same period of time.

So, what is behind the success of Axie Infinity?

Part of it can be attributed to the active Axie community and the cute pets – called Axies – that are used for battles. The other part is the new ‘Play-to-Earn’ gaming model. This model allows players to earn ‘real’ money by playing the game. Depending on the token price, the rewards are said to be somewhere between USD 300-500 per month. With the latest increase of AXS, they might be even higher.

The Play-To-Earn Model

To understand how the ‘Play-to-Earn’ model works, it is necessary to take a closer look at the game and the tokens involved.

There are basically three types of tokens in the game.

- Axie Infinity Shards (AXS)

- Smooth Love Potion (SLP)

- Axies, items, lands (NFTs)

To play the game players need at least three Axies. The Axies can be bought on the marketplace and currently cost around USD 200 or more.

To breed new Axies, players need 4 AXS and a certain number of SLP. To control the Axie population, it becomes increasingly expensive to breed Axies with same parents. After being used for breeding 7 times, Axies become sterile and cannot be used for further breeding.

| breed count | breed number | SLP cost |

| (0/7) | 1 | 150 |

| (1/7) | 2 | 300 |

| (2/7) | 3 | 450 |

| (3/7) | 4 | 750 |

| (4/7) | 5 | 1200 |

| (5/7) | 6 | 1950 |

| (6/7) | 7 | 3150 |

As all assets in the game are represented by NFTs and all rewards are paid in AXS or SLP, there are different ways for players to earn income:

» farming SLP and AXS by playing quests or battling other players

» participating in tournaments

» breeding new Axies and selling them on the marketplace

» speculating on rare Axies

In the future, it will also be possible to use AXS for staking. Staked AXS will allow token holders to earn additional AXS from the staking and treasury pool.

Legal and Regulatory Considerations

Now that we know the basic gaming mechanics and the functions of each token, it is time to get a better understanding of the legal and regulatory environment in Japan. As the results of the analysis vary considerably, it is necessary to assess each activity and token individually.

Farming of AXS/SLP: The farming of SLP and AXS by playing quests or battling other players is generally subject to the limitations under the Improper Premiums and Misleading Representations Act (IPMR). The IPMR provides limits for items and other assets that can be given away for ‘free’. In the case of play-to-earn models where players must make an initial investment to play the game, the amount that can be given away for free is limited to JPY 100,000 or 2 percent of the initial sales, whichever is higher, or – for initial investments below JPY 5,000 up to 20 times the price of the initial investment.